Choose the best answer. 1. When equipment is purchased with General Fund resources, which of the following

Question:

1. When equipment is purchased with General Fund resources, which of the following accounts should be debited in the General Fund?

a. Expenditures.

b. Equipment.

c. Encumbrances.

d. No entry should be made in the General Fund.

2. When equipment is purchased with General Fund resources, which of the following accounts should be debited in the governmental activities journal?

a. Expenditures.

b. Equipment.

c. Encumbrances.

d. No entry should be made in the governmental activities journal.

3. Goods for which a purchase order had been placed at an estimated cost of $1,600 were received at an actual cost of $1,550. The journal entry in the General Fund to record the receipt of the goods will include a

a. Debit to Encumbrances Outstanding for $1,600.

b. Credit to Vouchers Payable for $1,550.

c. Debit to Expenditures for $1,550.

d. All of the above are correct.

4. Which of the following properly represents the format of the government wide statement of net position?

a. Assets minus liabilities equal fund balance.

b. Assets and deferred inflows minus liabilities and deferred outflows equal fund balance.

c. Assets and deferred outflows minus liabilities and deferred inflows equal net position.

d. Assets and deferred inflows minus liabilities and deferred outflows equal net position.

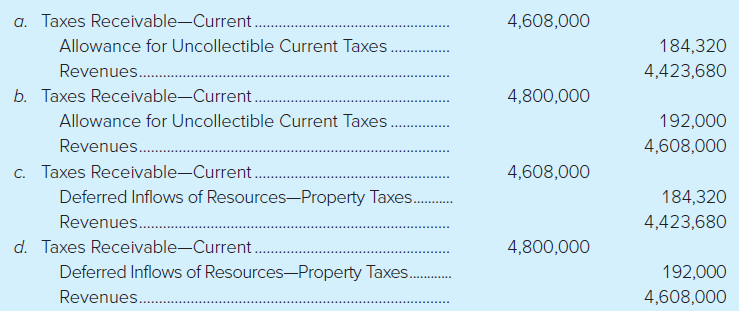

5. Garden City has calculated that General Fund property tax revenues of $4,608,000 are required for the current fiscal year. Over the past several years, the city has collected 96 percent of all property taxes levied. The city levied property taxes in the amount that will generate the required $4,608,000. Which of the following general journal entries would correctly record the property tax levy?

6. The Town of Freeport collected $3,000 of prior year property taxes six months after year-end. Which of the following would not be part of the entry to record collection of delinquent taxes in the General Fund?

a. A debit to Cash for $3,000.

b. A debit to Deferred Inflows of Resources€”Unavailable Revenues for $3,000.

c. A credit to Revenues for $3,000.

d. A debit to Taxes Receivable€”Delinquent for $3,000.

7. The Village of Frederick borrowed $1,000,000 from a local bank by issuing 4 percent tax anticipation notes. If the village repaid the tax anticipation notes six months later after collecting its next installment of property taxes, the General Fund journal entry to record the repayment will include

a. A debit to Tax Anticipation Notes Payable for $1,000,000.

b. A debit to Expenditures for $20,000.

c. A debit to Expenditures for $1,020,000.

d. Both a and b.

8. Which of the following transactions is reported on the government-wide financial statements?

a. An interfund loan from the General Fund to a special revenue fund.

b. Equipment used by the General Fund is transferred to an internal service fund that predominantly serves departments that are engaged in governmental activities.

c. The City Airport Fund, an enterprise fund, transfers a portion of boarding fees charged to passengers to the General Fund.

d. An interfund transfer is made between the General Fund and the Debt Service Fund.

9. Carroll City levies $200,000 of property taxes for its current fiscal year. One percent of the tax levy is expected to be uncollectible. The city collects $170,000 of its taxes during the year and another $25,000 during the first two months of the following year. In addition, the city collected $3,000 of prior year taxes during the first two months of the current fiscal year and another $2,000 during the remainder of the current fiscal year. What amount of property tax revenues should the city report in the government-wide financial statements for the current fiscal year?

a. $200,000

b. $198,000

c. $197,000

d. $195,000

10. Clarion Township was approved for a grant from the federal government. The grant provides for reimbursement up to $200,000 for expenditures incurred to weatherize homes for low-income persons. Upon notification that the grant had been approved, but before weatherization activities have begun, Clarion Township should

a. Make no journal entry.

b. Debit Due from Federal Government for $200,000.

c. Credit Deferred Inflows of Resources for $200,000.

d. Both b and c.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely