Choose the best answer. 1. Which of the following financial statements is prepared by fiduciary funds? a.

Question:

1. Which of the following financial statements is prepared by fiduciary funds?

a. Statement of fiduciary activities.

b. Statement of fiduciary net position.

c. Statement of fiduciary cash flows.

d. All of the above.

2. At the government-wide level, where are fiduciary funds reported?

a. In the Governmental Activities column.

b. In the Business-type Activities column.

c. As an internal balance in the total column.

d. Fiduciary funds are not reported at the government-wide level. Items 3 through 5 relate to the following information: The county collects taxes on behalf of the county, city, and a special purpose district. For 2020, the taxes to be levied by the government are

County ................................................$ 632,000

City .........................................................917,000

Special purpose district .........................26,000

Total ..................................................$1,575,000

3. What type of fund will the county use to account for tax collection and distribution?

a. The county will use a trust fund.

b. The county will use a custodial fund.

c. The county will use a special revenue fund.

d. The county will use the General Fund.

4. On the date the taxes are levied, the county would credit which of the following accounts in the fund used to account for tax collection and distribution?

a. Due to Other Funds and Governments.

b. Revenues€”Taxes.

c. Additions€”Other Funds and Governments.

d. Accrued Taxes.

5. If the county assessed a 1 percent administrative fee, it would be recorded by the county as a credit to

a. Revenue.

b. Transfer In.

c. Additions€”Fund Equity.

d. Due to County.

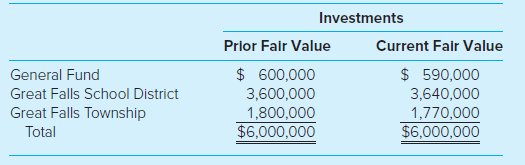

Items 6 through 8 relate to the following information: The city council of the City of Great Falls decided to pool the investments of its General Fund with those of Great Falls School District and Great Falls Township, each of which carried its investments at fair value as of the prior balance sheet date. All investments are revalued to current fair value at the date of the creation of the pool. At that date, the prior and current fair value of the investments of each of the participants were as follows:

6. At the date of the creation of the investment pool, each of the participants should

a. Debit its Fund Balance account and credit its Investments account for the prior fair value of the assets transferred to the pool.

b. Debit or credit its Investments account as needed to adjust its carrying value to current fair value. The offsetting entry in each fund should be to Fund Balance.

c. Debit Equity in Pooled Investments for the current fair value of investments pooled, credit Investments for the prior fair value of investments pooled, and credit or debit Revenues€”Change in Fair Value of Investments for the difference.

d. Make a memorandum entry only.

7. One day after creation of the pool, the investments that had belonged to Great Falls Township were sold by the pool for $1,760,000.

a. The loss of $40,000 is borne by each participant in proportion to its equity in the pool.

b. The loss of $10,000 is borne by each participant in proportion to its equity in the pool.

c. The loss of $40,000 is considered to be a loss borne by Great Falls Township.

d. The loss of $10,000 is considered to be a loss borne by Great Falls Township.

8. One month after creation of the pool, earnings on pooled investments totaled $59,900. It was decided to distribute the earnings to the participants, rounding the distribution to the nearest dollar. The Great Falls School District should receive

a. $36,000.

b. $35,940.

c. $36,339.

d. $37,000.

Items 9 and 10 are based on the following information: Fairview County contributes to and administers a single-employer defined benefit pension plan on behalf of its covered employees. The following information is available for the current year:

Current year benefits ............................................................................$150,000

Actual amount contributed to the plan ................................................145,000

Amortization of deferred amounts ...........................................................2,500

Net annual change in amounts normally expected to be liquidated with

expendable available financial resources ...................................................600

Interest on prior pension liabilities ...........................................................1,250

9. If the above information was for the General Fund, the current year pension expenditure would be equal to

a. $145,000.

b. $145,600.

c. $150,000.

d. $153,750.

10. If the above information was for a proprietary fund, the current year pension expense would be equal to

a. $145,000.

b. $145,600.

c. $150,000.

d. $153,750.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely