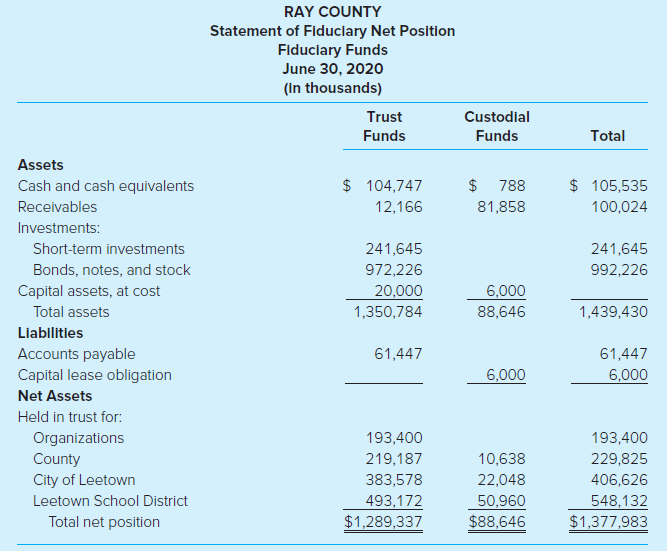

Ray County administers a tax custodial fund, an investment trust fund, and a private-purpose trust fund. The

Question:

Required

The statement as presented is not in accordance with GASB standards. Using Illustration A2€“10 (recall that the City and County of Denver statements use agency rather than custodial given they were issued prior to the change in terminology) and Illustration 8€“6 as examples, identify the errors (problems) in the statement and explain how the errors should be corrected.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely

Question Posted: