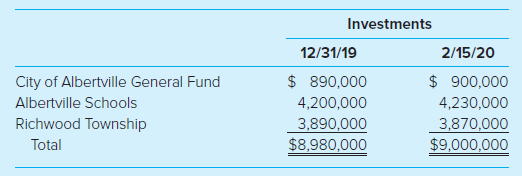

The Albertville City Council decided to pool the investments of its General Fund with Albertville Schools and

Question:

Required

a. Prepare the journal entries that should be made by the City of Albertville, Albertville Schools, and Richwood Township on February 15 to record their participation in the investment pool. (Entries for the investment pool trust fund will be made later.)

b. Prepare the journal entries to be made in the accounts of the investment pool trust fund to record the following transactions for the first year of operations:

(1) Record the investments transferred to the pool; assume that the investments of the city€™s General Fund were in U.S. Treasury notes and the investments of both the schools and the township were in certificates of deposit (CDs).

(2) On June 15, Richwood Township decided to withdraw $3,010,000 for a capital projects payment. At the date of the withdrawal, the fair value of the Treasury notes had increased by $30,000. Assume that the trust fund was able to redeem the CDs necessary to complete the withdrawal without a penalty but did not receive interest on the funds.

(3) On September 15, interest on Treasury notes in the amount of $50,000 was collected.

(4) Interest on CDs accrued at year-end amounted to $28,000.

(5) At the end of the year, undistributed earnings were allocated to the investment pool participants. Assume that there were no additional changes in the fair value of investments after the Richwood Township withdrawal. Round the amount of the distribution to each fund or participant to the nearest dollar.

c. Record the June 15 increase in each of the participant€™s funds.

d. Record the change in each participant€™s Equity in Pooled Investment account due to the September 15 treasury interest and December 31 CD interest accrual.

e. Explain how the investment trust fund would report the General Fund€™s interest in the investment pool and the Albertville School€™s interest in the investment pool.

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Step by Step Answer:

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely