The City of Manhattan, Kansas, prepares an annual Budget Book, a comprehensive document that includes a citywide

Question:

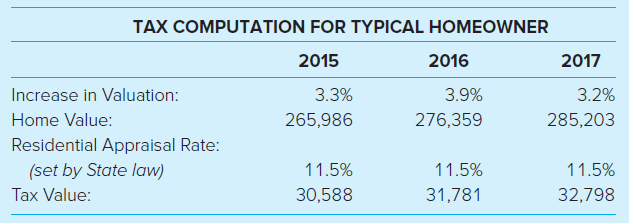

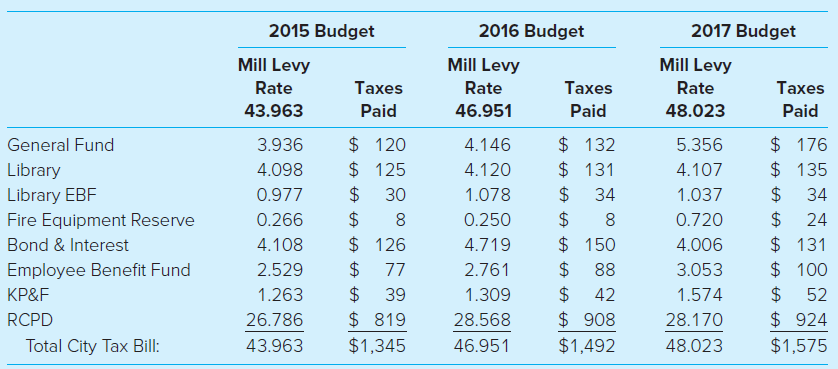

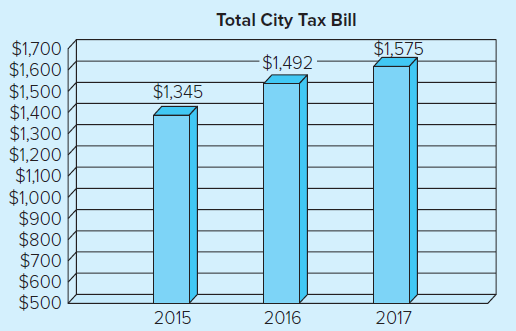

The City of Manhattan, Kansas, prepares an annual Budget Book, a comprehensive document that includes a citywide budget, as well as department budgets. The city has received the GFOA Distinguished Budget Award for more than 25 years. Following are graphical excerpts from the 2017 Budget Book that disclose typical taxpayer tax payments and primary revenue sources and functional expense categories.

Required

a. Examine the taxpayer calculation for the three-year period. What observations can you make from this illustration? What questions might you ask city budget officials at a public budget hearing?

b. Examine the pie charts and data provided for revenue sources and functional expenses. What are the primary revenue sources? What are the greatest expenditure categories? Taken together, do you have any questions regarding the city’s finances?

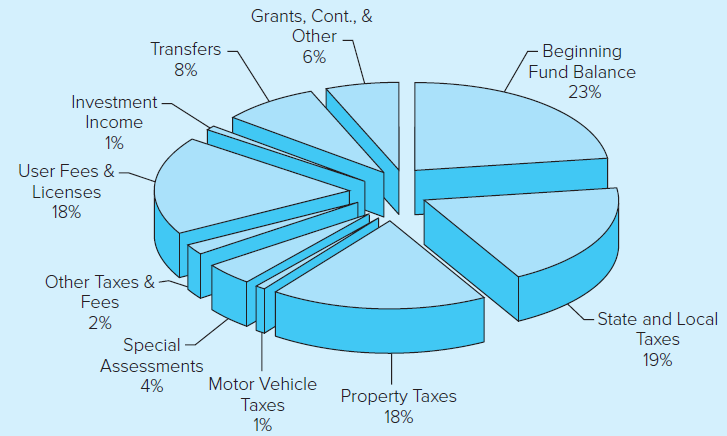

State & Local Sales Taxes: Includes city/county sales taxes, and franchise fees

State & Local Sales Taxes: Includes city/county sales taxes, and franchise fees

Property Taxes: Includes ad valorem, delinquent taxes, and PILOT’s

User Fees & Licenses: Includes licenses & permits, services and sales, program revenue, utility sales, and fines

Investment Income: Includes land rent, farm income, and misc. investment income

Transfers: Includes transfers for utility administrative services, sales tax, debt service, etc.

Grants, Cont., & Other Rev.: Includes contributions, grants, and misc. revenues

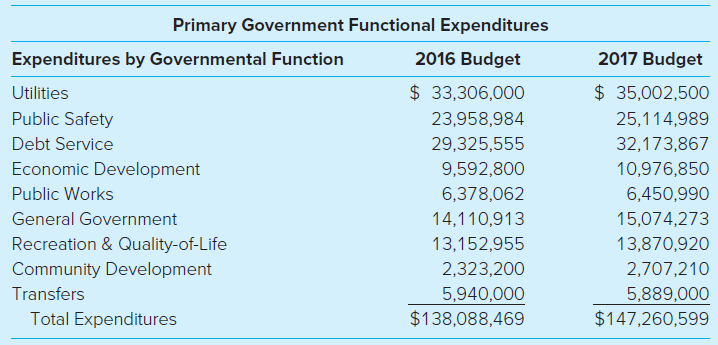

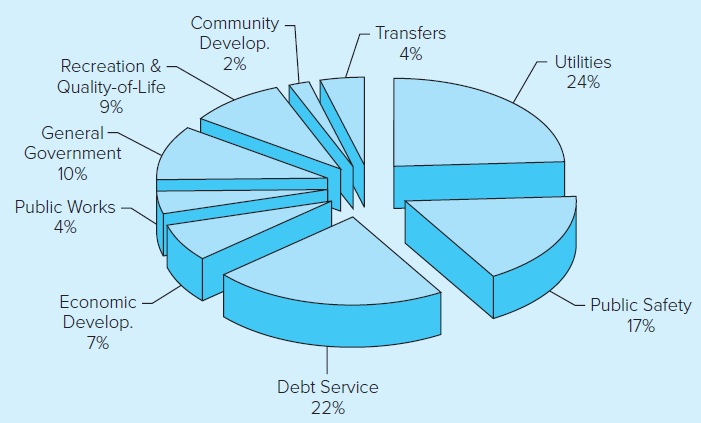

Utilities: Includes Water, Wastewater, and Storm water operations

Utilities: Includes Water, Wastewater, and Storm water operations

Public Safety: Includes Fire Operations, Administration, Technical Services, Building Maintenance, Fire Equipment Reserve, Fire Pension K. P. & F., and R.C.P.D

Debt Service: Includes all long-term debt payments

Economic Development: Includes General Improvement, Industrial Promotion, Economic Development Opportunity Fund, CIP Reserves, and Downtown Redevelopment T.I.F.

Public Works: Includes Admin., Streets, Engineering, Traffic, and Special Street & Highway

General Government: Includes General Government, Finance, Human Resources, Airport, Court, General Services, Outside Services, Municipal Parking Lot, City University Fund, Employee Benefits, and Special Alcohol Programs

Recreation & Quality-of-Life: Parks & Recreation, Zoo, Pools, Flint Hills Discovery Center, Library, and Library Employee Benefits

Community Development: Administration and Planning, Business Districts, and Tourism & Convention Fund

Transfers: Includes transfers from Sales Tax to General Fund and Special Revenue Funds

Step by Step Answer:

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely