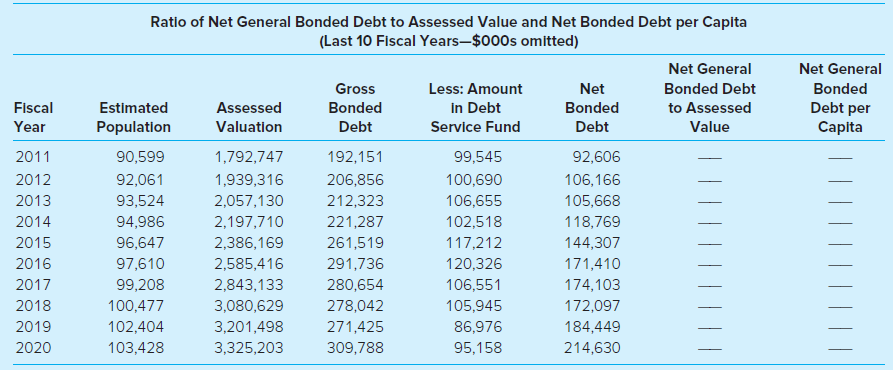

This case focuses on the analysis of a citys general obligation debt burden. After examining the accompanying

Question:

Required

a. What is your initial assessment of the trend of the city€™s general obligation debt burden?

b. Complete the table by calculating the ratio of Net General Bonded Debt to Assessed Value of taxable property and the Net General Bonded Debt per Capital. In addition, you learn that the average ratio of Net General Bonded Debt to Assessed Value for comparable-size cities in 2020 was 4.56 percent, and the average net general bonded debt per capital was $1,376. Based on time series analysis of your calculations and the benchmark information provided in this paragraph, is your assessment of the city€™s general obligation still the same as it was in requirement a, or has it changed? Explain.

Step by Step Answer:

Accounting for Governmental and Nonprofit Entities

ISBN: 978-1259917059

18th edition

Authors: Jacqueline L. Reck, James E. Rooks, Suzanne Lowensohn, Daniel Neely