The Board Shop, owned by Andrew John, sells skateboards in the summer and snowboards in the winter.

Question:

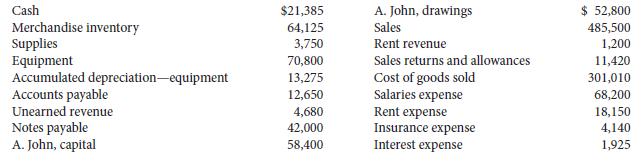

The Board Shop, owned by Andrew John, sells skateboards in the summer and snowboards in the winter. The shop has an August 31 fiscal year end and uses a perpetual inventory system. On August 1, 2014, the company had the following balances in its general ledger:

During August, the last month of the fiscal year, the company had the following transactions:

Aug. 1 Paid $1,650 for August’s rent.

2 Paid $6,500 on account.

4 Sold merchandise costing $7,900 for $12,260 cash.

5 Purchased merchandise on account from Orange Line Co., FOB shipping point, for $24,500.

5 Paid freight charges of $500 on merchandise purchased from Orange Line Co.

8 Purchased supplies on account for $345.

9 Refunded a customer $425 cash for returned merchandise. The merchandise had cost $265 and was returned to inventory.

10 Sold merchandise on account to Spider Company for $15,750, terms 2/10, n/30, FOB shipping point. The merchandise had a cost of $9,765.

11 Paid Orange Line Co. for half of the merchandise purchased on August 5.

12 Spider Company returned $750 of the merchandise it purchased. Board Shop issued Spider a credit memo. The merchandise had a cost of $465 and was returned to inventory.

15 Paid salaries, $3,100.

19 Spider Company paid the amount owing.

21 Purchased $9,900 of merchandise from Rainbow Option Co. on account, terms 2/10, n/30, FOB destination.

23 Returned $800 of the merchandise to Rainbow Option Co. and received a credit memo.

24 Received $525 cash in advance from customers for merchandise to be delivered in September.

30 Paid salaries, $3,100.

30 Paid Rainbow Option Co. the amount owing.

31 Andrew John withdrew $4,800 cash.

Adjustment and additional data:

1. A count of supplies on August 31 shows $755 on hand.

2. The equipment has an estimated eight-year useful life.

3. Of the notes payable, $6,000 must be paid on September 1 each year.

4. An analysis of the Unearned Revenue account shows that $3,750 has been earned by August 31. A corresponding $2,325 for Cost of Goods Sold will also need to be recorded for these sales.

5. Interest accrued on the note payable to August 31 was $175.

6. A count of the merchandise inventory on August 31 shows $76,560 of inventory on hand.

Instructions

(a) Create a general ledger account for each of the above accounts and enter the August 1 balances.

(b) Record and post the August transactions.

(c) Prepare a trial balance at August 31, 2014.

(d) Record and post the adjustments required at August 31, 2014.

(e) Prepare an adjusted trial balance at August 31, 2014.

(f) Prepare a multiple-step income statement, statement of owner’s equity, and classified balance sheet.

(g) Record and post closing entries.

(h) Prepare a post-closing trial balance at August 31, 2014.

Step by Step Answer:

Accounting Principles Part 1

ISBN: 978-1118306789

6th Canadian edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Kinnear, Joan E. Barlow