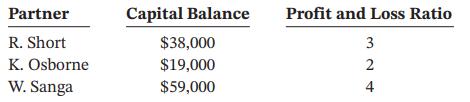

At April 30 of the current year, partners capital balances and the profit- and loss sharing ratio

Question:

At April 30 of the current year, partners’ capital balances and the profit- and loss sharing ratio in SOS Enterprises are as follows:

On May 1, SOSO Company is formed by admitting N. Osvald to the firm as a partner.

Instructions

Journalize the admission of Osvald under each of the following independent assumptions:

a. Osvald purchases 50% of Sanga’s ownership interest by paying Sanga $31,000 cash from personal funds.

b. Osvald invests $68,000 cash in the partnership for a 40% ownership interest.

c. Osvald invests $41,000 in the partnership for a 20% ownership interest.

d. Osvald invests $29,000 in the partnership for a 20% ownership interest.

Why would a new partner be willing to pay a bonus to the existing partners in order to join a partnership? Give an example of a situation where this might happen.

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak