At the beginning of its first year of operations, Northwoods Limited has 5,000, $4 preferred shares and

Question:

At the beginning of its first year of operations, Northwoods Limited has 5,000, $4 preferred shares and 50,000 common shares.

Instructions

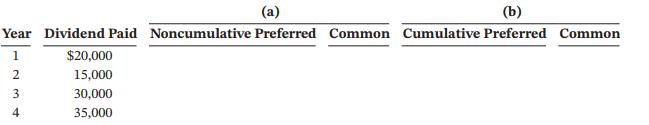

Using the format shown below, allocate the total dividend paid in each year to the preferred and common shareholders, assuming that the preferred shares are

(a) Noncumulative

(b) Cumulative.

Why would an investor choose to invest in common shares if preferred share dividends have a higher priority?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak

Question Posted: