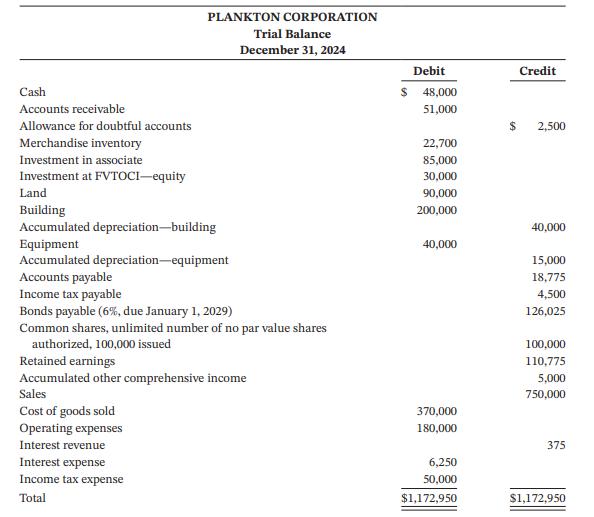

Plankton Corporations trial balance at December 31, 2024, is presented below: All transactions and adjustments for 2024

Question:

Plankton Corporation’s trial balance at December 31, 2024, is presented below:

All transactions and adjustments for 2024 have been recorded and reported in the trial balance except for the items described below.

Jan. 7 Issued 1,000 preferred shares for $25,000. In total, 100,000, $2, noncumulative, convertible, preferred shares are authorized. Each preferred share is convertible into five common shares.

Mar. 16 Purchased 800 common shares of Osborne Inc., to be held for trading purposes, for $24 per share.

July 1 Purchased $100,000 Solar Inc. 10-year, 5% bonds at 108.2, when the market interest rate was 4%. Interest is received semi-annually on July 1 and January 1. Plankton purchased the bonds to earn interest.

Aug. 2 Sold the Osborne common shares for $25 per share.

5 Invested $20,000 in a money-market fund.

Sept. 25 Five hundred of the preferred shares issued on January 7 were converted into common shares.

Oct. 24 Cashed in the money-market fund, receiving $20,000 plus $200 interest.

Nov. 30 Obtained a $50,000 bank loan by issuing a three-year, 6% note payable. Plankton is required to make equal blended payments of $1,521 at the end of each month. The first payment was made on December 31. Note that at December 31, $15,757 of the note payable is due within the next year.

Dec. 1 Declared the annual dividend on the preferred shares on December 1 to shareholders of record on December 23, payable on January 15.

31 Plankton owns 40% of RES. RES earned $20,000 and paid dividends of $1,200 in 2024. The fair value of the RES investment was $98,000.

31 Semi-annual interest is receivable on the Solar Inc. bonds on January 1, 2025. The bonds were trading at 106 on December 31, 2024.

31 The annual interest is due on the bonds payable on January 1, 2025. The par value of the bonds is $130,000 and the bonds were issued when the market interest rate was 7%.

31 The fair value of the long-term investment at FVTOCI—equity was $28,000. Ignore income tax calculation.

Instructions

a. Record the transactions.

b. Prepare an updated trial balance at December 31, 2024, that includes these transactions.

c. Using the income statement accounts in the trial balance, calculate income before income tax. Assuming Plankton has a 27% income tax rate, prepare the journal entry to adjust income taxes for the year. Note that Plankton has recorded $50,000 of income tax expense for the year to date. Update the trial balance for this additional entry. For the purposes of this question, ignore the income tax relating to other comprehensive income.

d. Prepare the following financial statements for Plankton:

(1) Income statement

(2) Statement of comprehensive income

(3) Statement of changes in shareholders’ equity

(4) Balance sheet.

For the purposes of this question, ignore the income tax on other comprehensive income.

e. Assuming instead that Plankton purchased the Solar Inc. bonds for trading purposes, describe how the investment and related income should be valued and reported in Plankton’s financial statements.

f. For each of Plankton’s investments, explain how the measurement and reporting of the investment and related income accounts might differ if Plankton were a private company reporting under ASPE.

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak