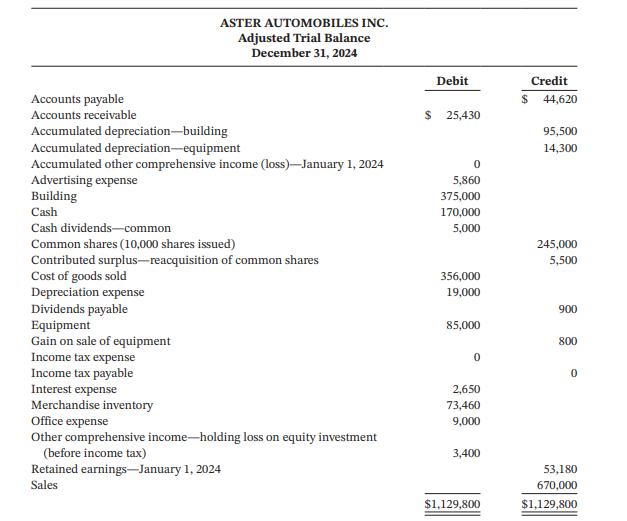

The adjusted trial balance for Aster Automobiles Inc. at December 31, 2024, is presented below. Asters income

Question:

The adjusted trial balance for Aster Automobiles Inc. at December 31, 2024, is presented below. Aster’s income tax rate is 25% and journal entries for income tax expense have not yet been prepared. There were no common share transactions during the year.

Instructions

a. Prepare a statement of comprehensive income on an all-inclusive basis. Use a multi-step format for the profit or loss section. (Ignore earnings per share.)

b. Prepare a statement of changes in shareholders’ equity for the year.

c. Prepare the shareholders’ equity section of the balance sheet at December 31, 2024.

Why is it important to report the changes that took place in shareholders’ equity during the year?

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 9781119786634

9th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak