Assuming that MNC entered into a forward contract to sell 10 million South Korean won on December

Question:

Assuming that MNC entered into a forward contract to sell 10 million South Korean won on December 1, 2017, as a fair value hedge of a foreign currency receivable, what is the net impact on its net income in 2017 resulting from a fluctuation in the value of the won?

a. No impact on net income.

b. $58.80 decrease in net income.

c. $2,000 decrease in net income.

d. $1,941.20 increase in net income.

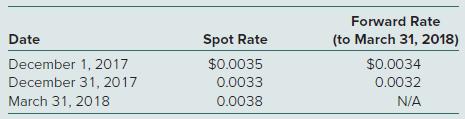

MNC Corp. (a U.S.-based company) sold parts to a South Korean customer on December 1, 2017, with payment of 10 million South Korean won to be received on March 31, 2018. The following exchange rates apply:

MNC’s incremental borrowing rate is 12 percent. The present value factor for three months at an annual interest rate of 12 percent (1 percent per month) is 0.9706.

Step by Step Answer:

Advanced Accounting

ISBN: 978-1259444951

13th edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupni