Ada Vidal established Exotic Bean Bags Inc. (EBBI) in 20X2 to distribute exotic bean bags featuring colourful

Question:

Until the end of 20X7, EBBI sold the bags through two of its own company-owned retail outlets in the Calgary area, as well as (1) through many other retail stores across Canada; (2) online via its website, www.exoticbeanbags.com , and; (3) for custom orders, directly to individuals or businesses.

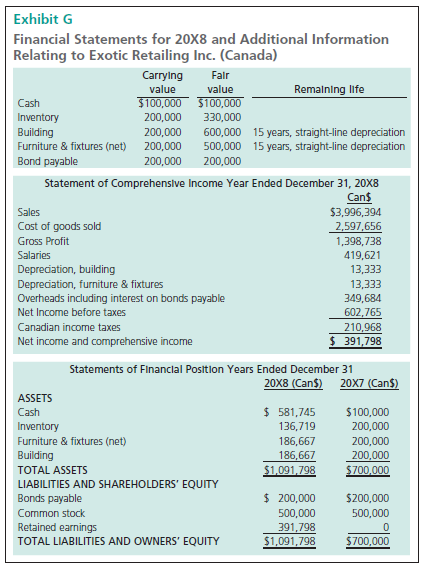

Late in 20X7, Ada realized that her core competency lay in designing bean bags and in obtaining contracts for customized bean bags from businesses and individuals. Therefore, she decided to sell the two retail outlets to a prospective buyer. Erin Mazur, a wealthy acquaintance of Ada, agreed to buy the two retailing facilities from EBBI. EBBI created a company called Exotic Retailing Inc. (ERI) on December 31, 20X7, and transferred the two retail outlets to ERI on that date. EBBI Canada sold 80% of the shares of ERI to Erin on December 31, 20X7, while retaining the remaining 20%. Erin paid EBBI $1,200,000 for her 80% share ownership of ERI.

The agreement between EBBI and ERI stipulates the following:

– EBBI will be the exclusive bean bags supplier to ERI. All bean bags sold by ERI must be EBBI bean bags. However, ERI is free to sell products other than bean bags that are supplied by other companies.

– For 20X8 only, EBBI will guarantee that ERI€™s income before taxes as a percentage of sales is equal to or greater than EBBI€™s 20X8 income before taxes as a percentage of sales on its consolidated SCI. If not, EBBI must pay ERI the deficiency.

– To preserve the monopoly of ERI in the Calgary area, EBBI is prohibited from selling its bags to other retailers in Calgary.

– In determining EBBI€™s profit percentage, a qualified professional accountant must prepare EBBI€™s consolidated statement of comprehensive income under IFRS.

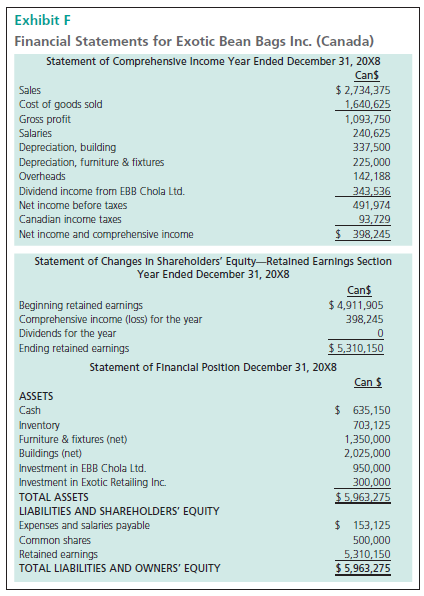

It is now January 20X9, and Ada wants to obtain a loan from EBBI€™s bank so that she can fund the expansion of EBBI€™s wholesale operations as well as the expansion of EBBI€™s sales of customized bean bags to individuals and businesses directly. The bank has asked Ada to provide EBBI€™s consolidated statement of comprehensive income for 20X8, prepared following international standards by a qualified accountant. Together, Ada and Erin approached a partner of Accounting Experts LLP (AE) to prepare the consolidated statement of comprehensive income of EBBI for 20X8. Ada and Erin provided AE with the additional information shown below, including the separate-entity financial statements for EBBI, EBBCL (translated into Canadian dollars), and ERI.

You recently joined AE as a staff accountant. The AE partner has assigned you the responsibility of preparing the EBBI consolidated statement and then drafting a report with recommendations to Ada and Erin.

Additional Information:

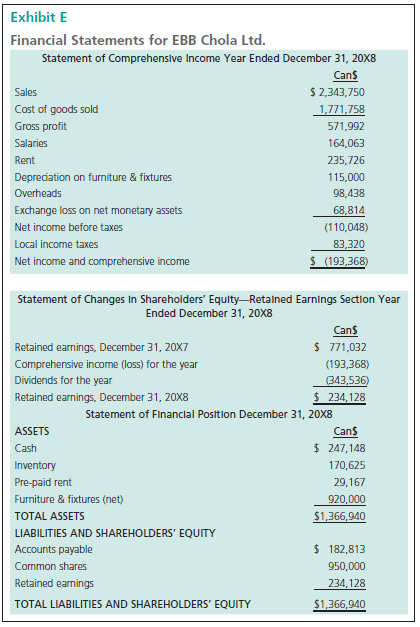

– The relevant financial statements of EBBCL, converted into Canadian dollars, are provided in Exhibit E.

– Erin notes that ERI€™s profit before taxes as a percentage of sales is less than the comparable figure on EBBI€™s separate-entity SCI. She had assumed that if such a comparison were to be made using the consolidated SCI of EBBI instead, the result would be similar. They need to understand the reasons for any difference and they also need to know if they should adjust their operating agreement for the future.

– EBBCL makes all of its sales to EBBI. EBBCL remits excess cash as dividends to EBBI in four equal instalments, each instalment at the end of each quarter.

– Ada thinks it is good for her business that the Chola kas has depreciated in value significantly vis-Ã -vis the Canadian dollar. This has reduced her cost of goods sold while having no impact on her sale prices in Canada, since EBBI has no competition in its niche in Canada. She does not expect the kas to recover in value compared with the Canadian dollar any time soon.

Additional information pertaining to Exotic Bean Bags Chola Ltd.:

– All sales made to EBB Inc. Canada by EBB Chola Ltd. are made at the same gross profit percentage on sales.

Additional information pertaining to Exotic Bean Bags Inc.:

– EBBI Canada had no inventory on January 1, 20X8, since the entire inventory received from EBB Chola Ltd. was in ER Inc.€™s retail facilities on that date.

– All sales made to ER Inc. by EBBI Canada are made at the same gross profit percentage on sales.

The carrying and fair values of ER€™s net identifiable assets on January 1, 20X8, were as shown in Exhibit G.

Additional information pertaining to Exotic Retailing Inc.:

– The buildings and furniture and fixtures had a further useful life of 15 years on January 1, 20X8. They are being depreciated on a straight-line basis assuming no salvage value.

– No dividends were declared by ER during the year.

Required

Draft a report for the AE partner that includes the required financial statements, all associated calculations, and the analysis and recommendations for Ada and Erin.

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay