Refer to Exercises 2-20A and 2-21A. Requirements 1. After journalizing the transactions of Exercise 2-20A, post the

Question:

Refer to Exercises 2-20A and 2-21A.

Requirements

1. After journalizing the transactions of Exercise 2-20A, post the entries to the ledger, using T-accounts. Key transactions by date. Determine the ending balance in each account.

2. Prepare the trial balance of Dr. Helen Samoa, P.C., at December 31, 2018.

3. From the trial balance, determine total assets, total liabilities, and total stockholders’ equity on December 31.

Exercise 2-20A & Exercise 2-21A.

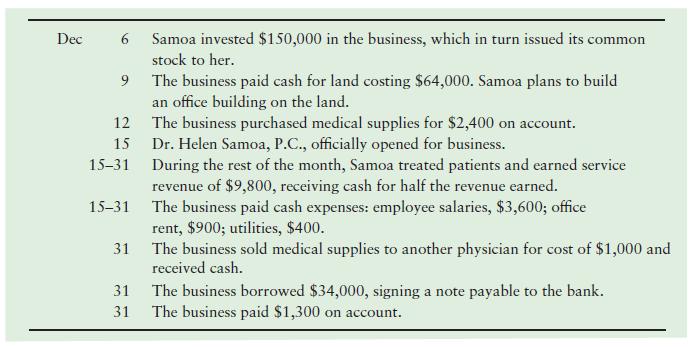

Dr. Helen Samoa opened a medical practice specializing in physical therapy. During the first month of operation (December), the business, titled Dr. Helen Samoa, Professional Corporation (P.C.), experienced the following events:

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial Accounting

ISBN: 978-0134725987

12th edition

Authors: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.