Wear Wraith (WW) Co.s main activity is the extraction and supply of building materials including sand, gravel,

Question:

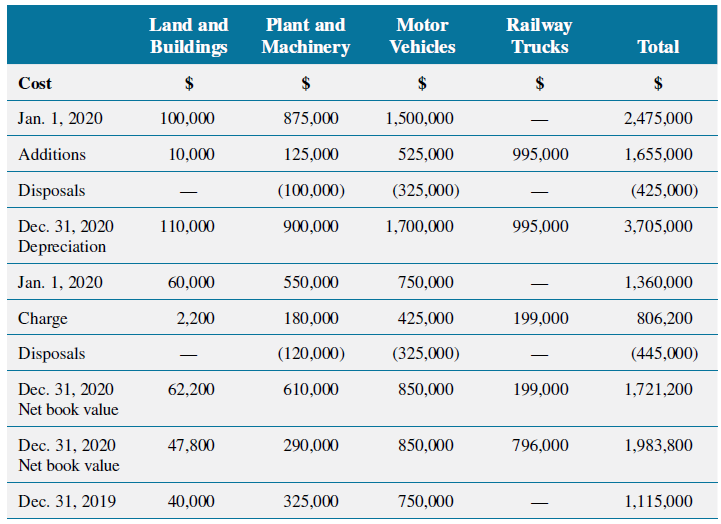

Wear Wraith (WW) Co.’s main activity is the extraction and supply of building materials including sand, gravel, cement, and similar aggregates. The company’s year end is December 31 and your firm has audited WW for a number of years. The main assets on the statement of financial position are non-current assets. The following draft non-current asset note for the financial statements has been prepared. The note has not been reviewed by the senior accountant and so may contain errors.

Non-current asset note (draft ):

Depreciation rates stated in the financial statements are all based on cost and calculated using the straight-line basis. The rates are:

• Land and buildings (2 percent)

• Plant and machinery (20 percent)

• Motor vehicles (33 percent)

• Railway trucks (20 percent)

Disposals in the motor vehicles category relate to vehicles that were five years old.

– Land and buildings relate to company offices and land for those offices.

– Plant and machinery include extraction equipment such as digge and dump trucks used to extract sand and gravel, etc.

– Motor vehicles include large trucks to transport the sand, gravel, etc.

– Railway trucks are containers used to transport sand and gravel over long distances on the railway network.

Required

a. List the audit work you should perform on railway trucks.

b. You have just completed your analytical procedures of the non-current assets note.

i. Excluding railway trucks, identify and explain any issues with the non-current asset note to raise with management.

ii. Explain how each issue could be resolved.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Auditing A Practical Approach

ISBN: 978-1119566007

3rd Canadian edition

Authors: Robyn Moroney, Fiona Campbell, Jane Hamilton, Valerie Warren