You are auditing the financial statements for your new client, Paper Packaging Corporation, a manufacturer of paper

Question:

You are auditing the financial statements for your new client, Paper Packaging Corporation, a manufacturer of paper containers, for the year ended March 31, 2019. Paper Packaging is a public company. Paper Packaging’s previous auditors had issued a going concern opinion on the March 31, 2018, financial statements for the following reasons:

- Paper Packaging had defaulted on $10 million of unregistered debentures sold to three insurance companies, which were due in 2018, and the default constituted a possible violation of other debt agreements.

- The interest and principal payments due on the remainder of a 10-year credit agreement, which began in 2014, would exceed the cash flows generated from operations in recent years.

- The company had disposed of certain operating units. The proceeds from the sale were subject to possible adjustment through arbitration proceedings, the outcome of which was uncertain at year-end.

- Various lawsuits were pending against the company.

- The company was in the midst of tax proceedings as a result of an examination of the company’s federal income tax returns for a period of 12 years. You find that the status of the above matters is as follows at year-end, March 31, 2019:

- The company is still in default on $4.6 million of the debentures due in 2018 but is trying to negotiate a settlement with remaining bondholders. A large number of bondholders have settled their claims at significantly less than par.

- The company has renegotiated the 2014 credit agreement, which provides for a two-year moratorium on principal payments and interest at 8 percent. It also limits net losses ($2.25 million for 2019) and requires a certain level of defined cumulative quarterly operating income to be maintained.

- The arbitration proceedings were resolved in 2019.

- The legal actions were settled in 2018.

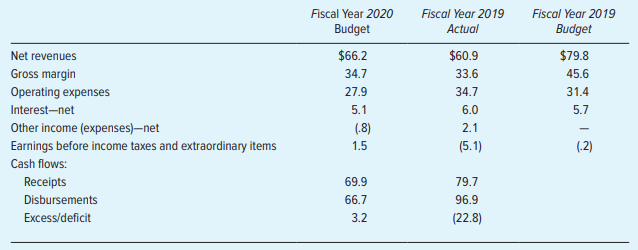

- Most of the tax issues have been resolved, and, according to the company’s outside legal counsel, those remaining will result in a net cash inflow to the company. At year-end, Paper Packaging had a cash balance of $5.5 million and expects to generate a net cash flow of $3.2 million in the upcoming fiscal year. The following information about Paper Packaging’s plans for its operations for the fiscal year ending in 2020 may also be useful in arriving at a decision.

Required (for this question, you may wish to reference extant auditing standards):

a. What should you consider in deciding whether to discuss a going concern uncertainty in your report?

b. How much influence should the report on the March 31, 2018, financial statements have on your decision?

c. Should your report for the year ended March 31, 2019, include a discussion of a going concern uncertainty? Briefly explain why or why not.

Debenture DefinitionDebentures are corporate loan instruments secured against the promise by the issuer to pay interest and principal. The holder of the debenture is promised to be paid a periodic interest and principal at the term. Companies who... Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Auditing & Assurance Services A Systematic Approach

ISBN: 978-1260687637

11th Edition

Authors: William F Messier Jr, Steven M Glover, Douglas F Prawitt