Anne Aylor, Inc. (Anne Aylor) is a leading national specialty retailer of high-quality womens apparel, shoes, and

Question:

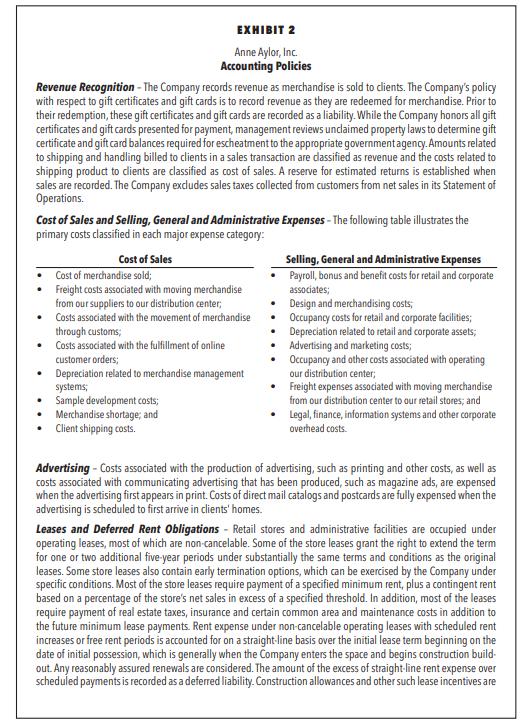

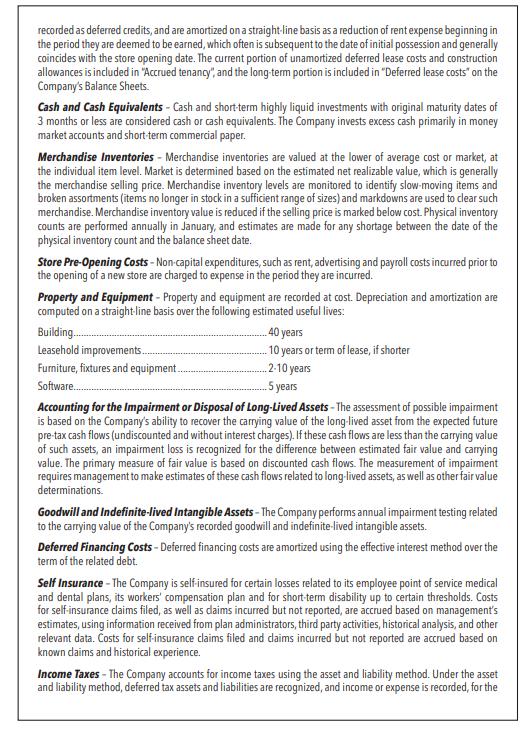

Anne Aylor, Inc. (Anne Aylor) is a leading national specialty retailer of high-quality women’s apparel, shoes, and accessories sold primarily under the “Anne Aylor” brand name. Anne Aylor is a highly recognized national brand that defines a distinct fashion point of view. Anne Aylor merchandise represents classic styles, updated to reflect current fashion trends. Company stores offer a full range of career and casual separates, dresses, tops, weekend wear, shoes and accessories coordinated as part of a total wardrobing strategy. The company places a significant emphasis on customer service. Company sales associates are trained to assist customers in merchandise selection and wardrobe coordination, helping them achieve the “Anne Aylor” look while maintaining the customers’ personal styles.

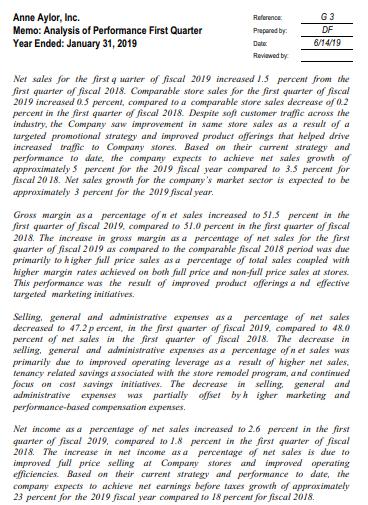

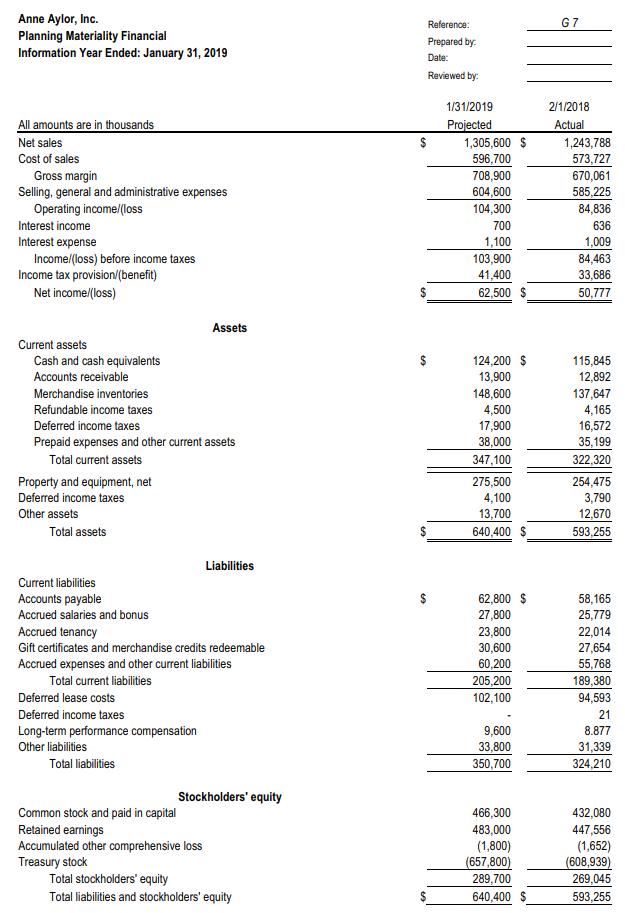

The company follows the standard fiscal year of the retail industry, which is a 52- or 53- week period ending on the Saturday closest to January 31 of the following year. Net revenue for the year ended February 1, 2018 (referred to as fiscal 2018) was $1.2 billion and net income was $50.8 million.

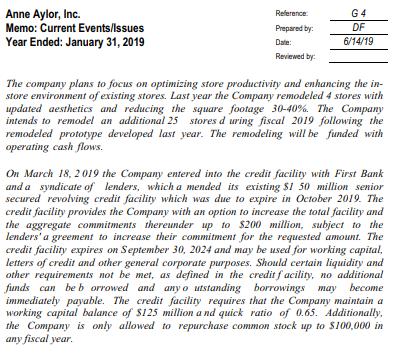

At the end of fiscal 2018, the company operated approximately 584 retail stores located in 46 states under the name Anne Aylor. The company’s core business focuses on relatively affluent, fashion-conscious professional women with limited shopping time. Substantially all of the company’s merchandise is developed in house by its product design and development teams. Production of merchandise is sourced to 131 independent manufacturers located in 19 countries. Approximately 45 percent, 16 percent, 13 percent, 12 percent, and 9 percent of the company’s merchandise is manufactured in China, Philippines, Indonesia, India, and Vietnam, respectively. Merchandise is distributed to the company’s retail stores through a single distribution center, located in Louisville, Kentucky.

Anne Aylor stock trades on The New York Stock Exchange and Anne Aylor is required to have an integrated audit of its consolidated financial statements and its internal control over financial reporting in accordance with the standards of the Public Company Accounting Oversight Board (United States). As of the close of business on March 14, 2018 Anne Aylor had 48,879,663 shares of common stock outstanding with a trading price of $22.57.

REQUIRED

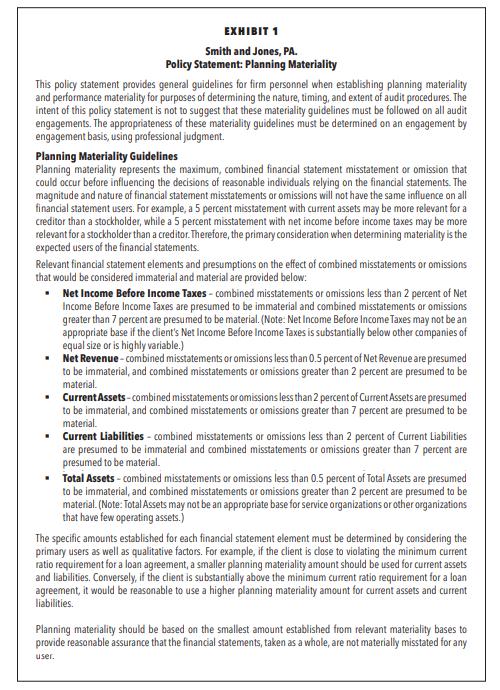

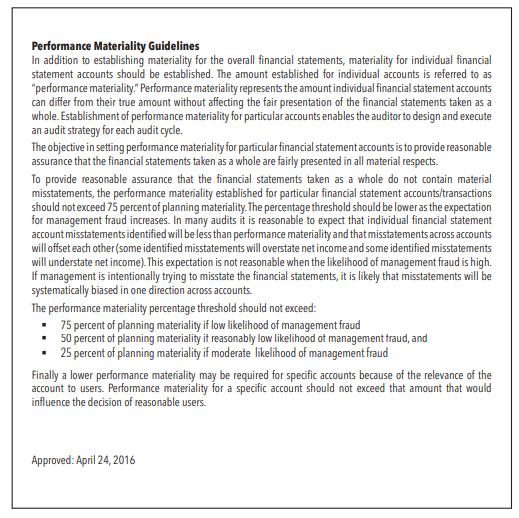

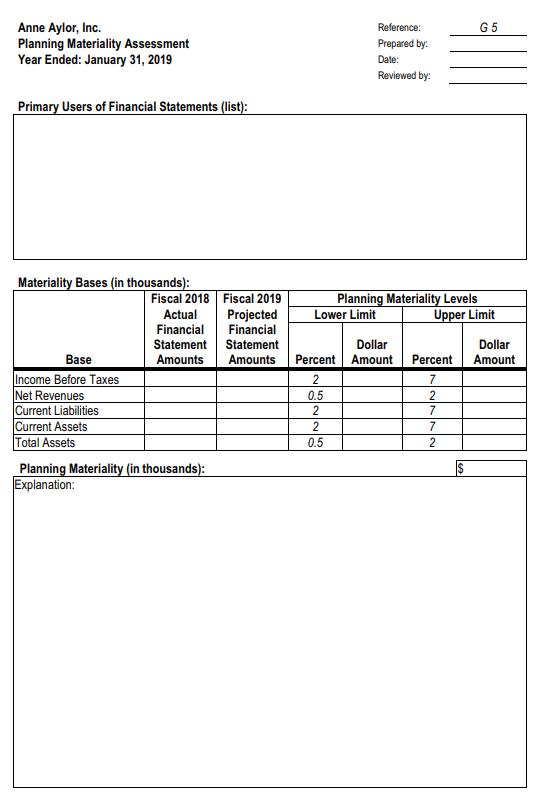

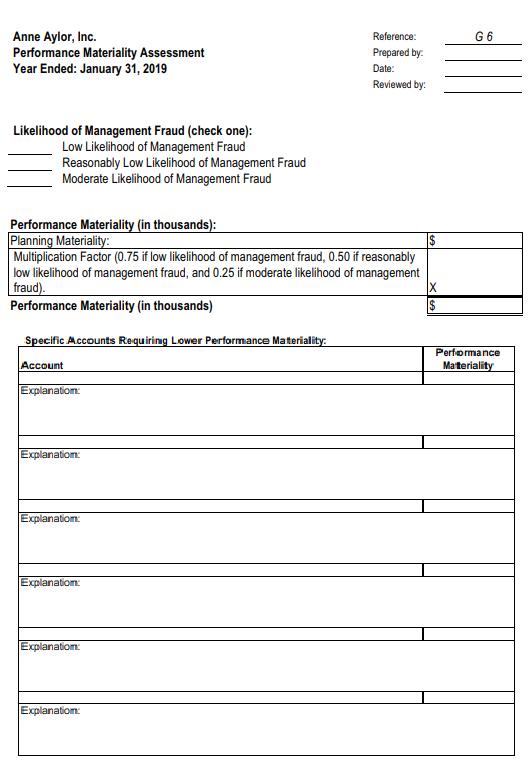

[1] Review Exhibits 1 and 2; audit memos G-3 and G-4; and audit schedules G-5, G-6 and G-7. Based on your review, answer each of the following questions:

[a] Why are different materiality thresholds relevant for different audit engagements?

[b] Why are different materiality bases considered when determining planning materiality?

[c] Why is the materiality base that results in the smallest threshold generally used for planning purposes?

[d] Why is the risk of management fraud considered when determining performance materiality?

[e] Why might an auditor not use the same performance materiality amount or percentage of account balance for all financial statement accounts?

[f] Why does the combined total of individual account performance materiality commonly exceed the estimate of planning materiality?

[g] Why might certain trial balance amounts be projected when considering planning materiality?

[2] Based on your review of the Exhibits (1 and 2) and audit memos (G-3 and G-4), complete audit schedules G-5, G-6 and G-7.

Step by Step Answer:

Auditing Cases An Interactive Learning Approach

ISBN: 9780134421827

7th Edition

Authors: Mark S Beasley, Frank A. Buckless, Steven M. Glover, Douglas F Prawitt