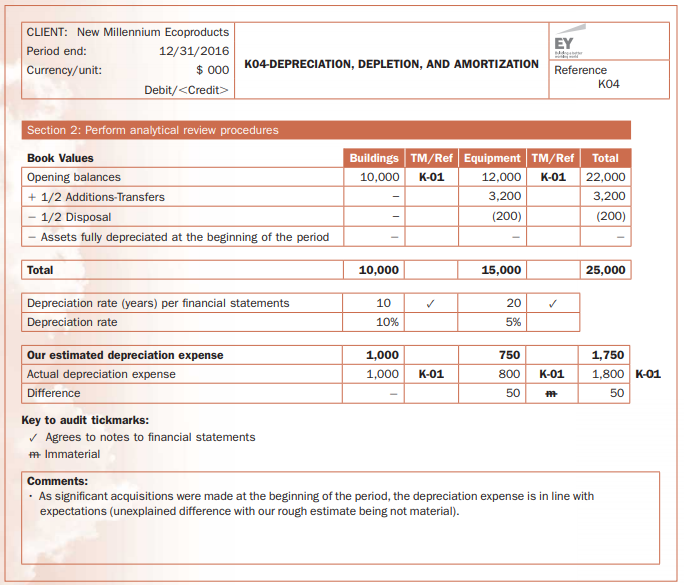

The following is a copy of the auditors working paper relating to the testing of depreciation expense

Question:

The following is a copy of the auditor’s working paper relating to the testing of depreciation expense for the client New Millennium Ecoproducts.

Required

(a) The opening book value balances of the assets are carried forward from the prior period and reconciled to the general ledger (K-01). The auditor then adds half of the amount recorded as additions and subtracts half of the amount recorded as disposals in order to calculate the total balance to be multiplied by the depreciation rate. Why does the auditor use half of these values?

(b) The difference between the estimated depreciation expense and the actual depreciation expense is dismissed as immaterial. Do you agree? Explain.

Step by Step Answer:

Auditing A Practical Approach

ISBN: 978-1118849415

2nd Canadian edition

Authors: Fiona Campbell, Robyn Moroney, Jane Hamilton, Valerie Warren