The following questions concern the use of analytical procedures during an audit. Select the best response. a.

Question:

The following questions concern the use of analytical procedures during an audit. Select the best response.

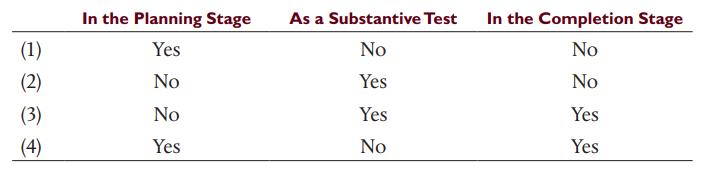

a. For all audits of financial statements made in accordance with auditing standards, the use of analytical procedures is required to some extent

b. Which of the following situations has the best chance of being detected when a CPA compares 2019 revenues and expenses with the prior year and investigates all changes exceeding a fixed percent?

(1) An increase in property tax rates has not been recognized in the company’s 2019 accrual.

(2) The cashier began lapping accounts receivable in 2019.

(3) Because of worsening economic conditions, the 2019 provision for uncollectible accounts was inadequate.

(4) The company changed its capitalization policy for small tools in 2019.

c. Which of the following would not be considered to be an analytical procedure?

(1) Estimating payroll expense by multiplying the number of employees by the average hourly wage rate and the total hours worked

(2) Projecting the error rate by comparing the results of a statistical sample with the actual population characteristics

(3) Computing accounts receivable turnover by dividing credit sales by the average net receivables

(4) Developing the expected current-year sales based on the sales trend of the prior 5 years

Step by Step Answer:

Auditing And Assurance Services An Integrated Approach

ISBN: 9780135176146

17th Edition

Authors: Alvin A. Arens, Randal J. Elder, Mark S. Beasley