Artero Corporation is a traditional toy products retailer that recently started an Internet-based subsidiary that sells toys

Question:

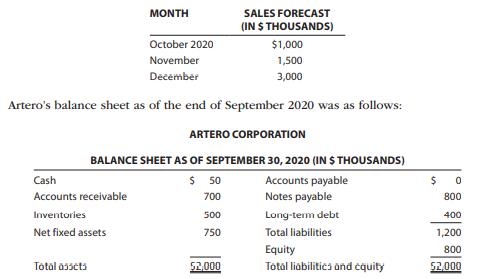

Artero Corporation is a traditional toy products retailer that recently started an Internet-based subsidiary that sells toys online. A markup is added on goods the company purchases from manufacturers for resale. Swen Artero, the company president, is preparing for a meeting with Jennifer Brown, a loan officer with First Banco Corporation, to review year-end financing requirements. After discussions with the company’s marketing manager, Rolf Eriksson, and finance manager, Lisa Erdinger, sales over the last three months of 2020 are forecasted to be:

All sales are made on credit terms of net 30 days and are collected the following month. No bad debts are anticipated. The accounts receivable on the balance sheet at the end of September thus will be collected in October, the October sales will be collected in November, and so on. Inventory on hand represents a minimum operating level (or safety stock), which the company intends to maintain. Cost of goods sold averages 80 percent of sales. Inventory is purchased in the month of sale and paid for in cash. Other cash expenses average 7 percent of sales. Depreciation is $10,000 per month. Assume taxes are paid monthly and the effective income tax rate is 40 percent for planning purposes. The annual interest rate on outstanding long-term debt and bank loans (notes payable) is 12 percent. There are no capital expenditures planned during the period, and no dividends will be paid. The company’s desired end-of-month cash balance is $80,000. The president hopes to meet any cash shortages during the period by increasing the firm’s notes payable to the bank. The interest rate on new loans will be 12 percent.

A. Prepare monthly pro forma income statements for October, November, and December and for the quarter ending December 31, 2020.

B. Prepare monthly pro forma balance sheets at the end of October, November, and December 2020.

C. Prepare both a monthly cash budget and pro forma statements of cash flows for October, November, and December 2020.

D. Describe your findings and indicate the maximum amount of bank borrowing that is needed.

Step by Step Answer: