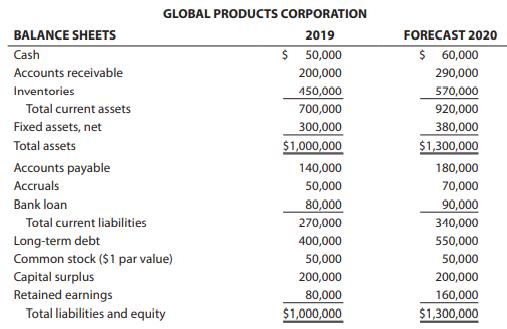

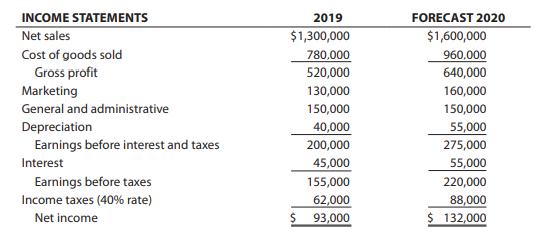

Following are financial statements (historical and forecasted) for the Global Products Corporation. A. Assume that the cash

Question:

Following are financial statements (historical and forecasted) for the Global Products Corporation.

A. Assume that the cash account includes only required cash. Determine the dollar amount of equity valuation cash flow for 2020.

B. Now assume that Global Products’ required cash is set at 3 percent of sales. Any additional cash would be surplus cash. Re-estimate the dollar amount of equity valuation cash flow for 2020.

C. Let’s assume that investors in Global Products want to estimate the venture’s present value at the end of 2019. Forecasted financial statements reflect the stepping-stone year. Cash flows are expected to grow at a perpetual 8 percent annual rate beginning in 2021. Assume that all cash is required cash as was done in Part A. What is Global Products’ present value if investors want an annual rate of return of 25 percent?

D. Work with the assumptions in Part B about Global Products’ required cash being 3 percent of sales. Calculate the present value of the Global Products venture at the end of 2019 if investors want an annual rate of return of 25 percent and cash flows are expected to grow at a perpetual 8 percent annual rate beginning in 2021.

Step by Step Answer: