Since 1980, average mortgage interest rates have fluctuated from a low of under 6% to a high

Question:

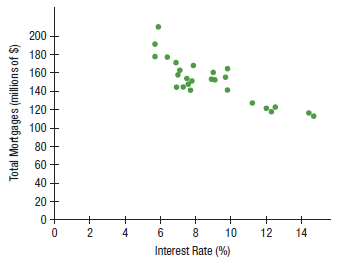

Since 1980, average mortgage interest rates have fluctuated from a low of under 6% to a high of over 14%. Is there a relationship between the amount of money people borrow and the interest rate that’s offered? Here is a scatterplot of Total Mortgages in the country (in millions of 2005 dollars) vs. Interest Rate at various times from 1980 to 2006. The correlation is –0.84.

a) Describe the relationship between Total Mortgages and Interest Rate.

b) If we standardized both variables, what would the correlation coefficient between the standardized variables be?

c) If we were to measure Total Mortgages in thousands of dollars instead of millions of dollars, how would the correlation coefficient change?

d) Suppose that in another year, interest rates were 11%, and mortgages totalled $250 million. How would including that year with these data affect the correlation coefficient?

e) Do these data provide proof that if mortgage rates are lowered, people will take out more mortgages? Explain.

Step by Step Answer:

Business Statistics

ISBN: 9780133899122

3rd Canadian Edition

Authors: Norean D. Sharpe, Richard D. De Veaux, Paul F. Velleman, David Wright