Federal government regulations require that people loaning money to consumers disclose the true annual interest rate of

Question:

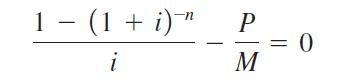

Federal government regulations require that people loaning money to consumers disclose the true annual interest rate of the loan. The formulas for calculating this interest rate are very complex. For example, suppose P dollars is loaned, with the money to be repaid in n monthly payments of M dollars each. Then the true annual interest rate is found by solving the equation

for i, the monthly interest rate, and then multiplying i by 12 to get the true annual rate. This equation can best be solved by Newton’s method. (This is how the financial function IRR (Internal Rate of Return) is computed in Microsoft Excel.)

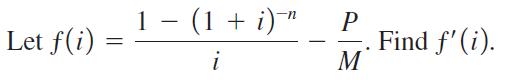

(a)

(b) Form the quotient ƒ(i)/ƒ′(i).

(c) Suppose that P = $4000, n = 24, and M = $197. Let the initial guess for i be i1 = 0.01. Use Newton’s method and find i2.

(d) Find i3.

Step by Step Answer: