Alberto is a clothing wholesaler. His draft profit for the year ended 30 September 203 was $24,920.

Question:

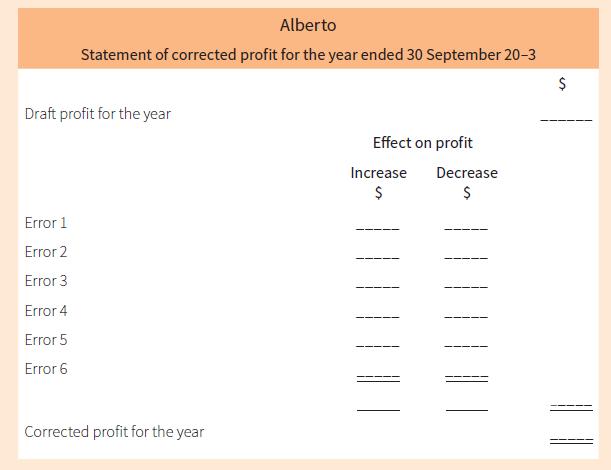

Alberto is a clothing wholesaler. His draft profit for the year ended 30 September 20–3 was $24,920. He then discovered the following errors:

1. One page of the sales journal had been overcast by $1,000.

2. Drawings by Alberto from the business bank account, $900, had been recorded as capital introduced.

3. No entry had been made for office expenses paid in cash, $40.

4. No entry had been made for the sale of a motor vehicle. This had originally cost $22,500 and had been depreciated by $10,980. A cheque was received for $12,000.

5. No entry had been made for cash discount, $50, received from Ted, a credit supplier.

6. $1,450 paid to Kaleem, a credit supplier, had been debited to the account of Kalid, another credit supplier.

Complete the statement of corrected profit for the year ended 30 September 20–3. Where an error does not affect the profit write ‘no effect’.

Step by Step Answer:

Cambridge IGCSE And O Level Accounting Coursebook

ISBN: 9781316502778

2nd Edition

Authors: Catherine Coucom