Diksha and Padmaja are in partnership. Their financial year ends on 31 July. Their partnership agreement provides

Question:

Diksha and Padmaja are in partnership. Their financial year ends on 31 July.

Their partnership agreement provides for:

• Interest on capital at 4% per annum

• An annual salary of $4,000 for Padmaja

• Interest on drawings at 2 1/2% per annum

• Residual profits and losses to be shared in the ratio of 2:1.

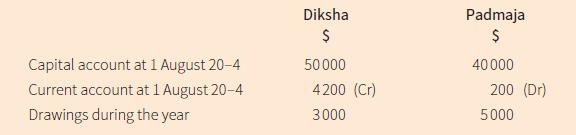

The following information is available:

The profit for the year ended 31 July 20–5 was $11,240.

a. Prepare the profit and loss appropriation account for the year ended 31 July 20–5.

b. Write up Padmaja’s current account for the year ended 31 July 20–5. Balance the account and bring down the balance on 1 August 20–5.

c. Suggest two reasons why partners maintain both a capital and a current account for each partner.

Step by Step Answer:

Cambridge IGCSE And O Level Accounting Coursebook

ISBN: 9781316502778

2nd Edition

Authors: Catherine Coucom