Bauman Corporation is a major distributor of school portables. All sales have terms 1/10, n/15. During July,

Question:

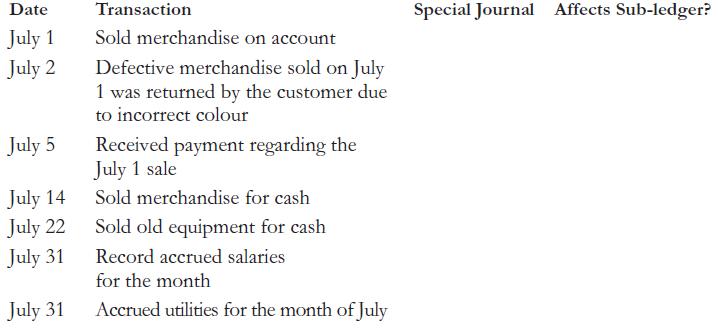

Bauman Corporation is a major distributor of school portables. All sales have terms 1/10, n/15. During July, the following select transactions occurred. For each transaction, identify into which special journal it should be journalized. Use SJ for sales journal, CRJ for cash receipts journal, and GJ for general journal. Also indicate if the accounts receivable sub-ledger is affected.

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting A Practical Approach

ISBN: 978-0134166698

13th Canadian edition

Authors: Jeffrey Slater, Debra Good

Question Posted: