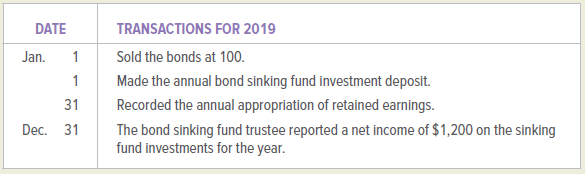

Market Research, Inc., has outstanding $200,000 face value, 10 percent bonds payable dated January 1, 2019, and

Question:

INSTRUCTIONS

1. Prepare entries in general journal form to record the 2019 transactions.

2. Prepare the partial balance sheet for December 31, 2028, showing the presentation of the Bond Sinking Fund Investment and the Retained Earnings Appropriated for Bond Retirement (assume Retained Earnings€”Unappropriated has a balance of $325,000).

3. Prepare the journal entries to retire the bonds and remove the appropriation of retained earnings on January 1, 2029.

On December 31, 2028, the balance in the Bond Sinking Fund Investment account is $200,000. The balance in the Retained Earnings Appropriated for Bond Retirement account is also $200,000.

Analyze: What percentage of total retained earnings had been allocated for bond retirement at December 31, 2028?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

College Accounting Chapters 1-30

ISBN: 978-1259631115

15th edition

Authors: John Price, M. David Haddock, Michael Farina