Ramirez Company has the following data for the weekly payroll ending January 31. Employees are paid 1

Question:

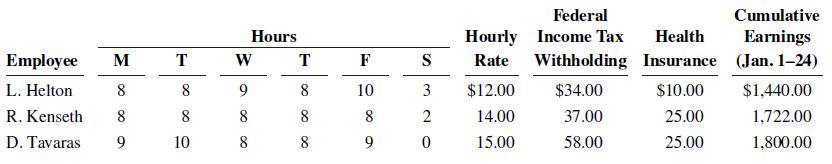

Ramirez Company has the following data for the weekly payroll ending January 31.

Employees are paid 1½ times the regular hourly rate for all hours worked in excess of 40 hours per week. The 7.65% FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128,400 and the Medicare tax rate of 1.45% on all salaries and wages.

Instructions

a. Prepare the payroll register for the weekly payroll.

b. Prepare the journal entry to record the payroll.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting

ISBN: 1986

1st Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Deanna C. Martin, Jill E. Mitchell

Question Posted: