Refer to Exercise 7A-3 and assume that the state changed Bowling Company?s SUTA tax rate to 4.6%.

Question:

Refer to Exercise 7A-3 and assume that the state changed Bowling Company?s SUTA tax rate to 4.6%. What effect would this change have on the total payroll tax expense?

Exercise 7A-3

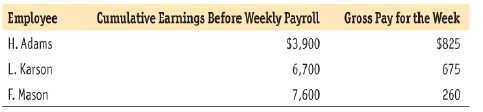

From the following information, calculate the payroll tax expense for Bowling Company for the payroll of April 9:

Transcribed Image Text:

Employee Cumulative Earnings Before Weekly Payroll Gross Pay for the Week H. Adams $3,900 $825 L. Karson 6,700 675 F. Mason 7,600 260

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

Payroll Taxes 54 Merit Rating P...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

College Accounting A Practical Approach

ISBN: 9780134729312

14th Edition

Authors: Jeffrey Slater, Mike Deschamps

Question Posted:

Students also viewed these Business questions

-

Refer to Exercise 7B-3. If D. Toll earned $3,000 for the week instead of $320, what effect would this change have on the total payroll tax expense? In Exercise7B-3. Employee 0. Barns 0. Hienze D....

-

Refer to Exercise 7A-3. If R. Robins earned $2,500 for the week instead of $300, what effect would this change have on the total payroll tax expense? In Exercise7A-3. Employee U. Acorn F. Jackson R....

-

Refer to Exercise 7B-3 and assume that the state changed Aims SUTA tax rate to 3.5%. What effect would this change have on the total payroll tax expense? In Exercise7B-3. Employee 0. Barns 0. Hienze...

-

The following are selected transactions of Bridgeport Department Store Ltd. for the current year ended December 31. Bridgeport is a private company operating in the province of Manitoba where PST is...

-

After heating to 200 °C, the following compound is converted 95% yield into an isomer A that can be hydrogenated o cyclodecane. Give the structure of A, including its stereo chemistry.

-

Describe the primary goals of the motivation function of HRM.

-

An investment is guaranteed to have a unique value of IRR if which of the following is true? a. Alternating positive and negative cash flows b. An initial negative cash flow followed by all positive...

-

Ratio analysis Required Use the financial statements for Bernard Company from Problem 13-22A to calculate the following ratios for 2012 and 2011: a. Working capital b. Current ratio c. Quick ratio d....

-

Using Doug Melville's checklist from his TEDx Talk evaluate which of his recommendations for improving diversity awareness are most useful to business leaders, and why.

-

From the following information of Hindustan Construction Company Limited, you are required to prepare a Statement of Profit and Loss for the year ended on 31st March, 2017: Gross Sales / Revenue from...

-

From the following information, calculate the payroll tax expense for Bowling Company for the payroll of April 9: The FICA tax rate for OASDI is 6.2% on the first $127,200 earned, and Medicare is...

-

Refer to Exercise 7A-3 . If F. Mason earned $2,100 for the week instead of $260, what effect would this change have on the total payroll tax expense? Exercise 7A-3 From the following information,...

-

Explain how the conversion of securities firms to a bank holding company (BHC) structure might reduce their risk.

-

The two masses P (5 Kg) and Q (unknown) are suspended as shown by this network of cords. The points A and D correspond to the attachments to the walls. www What should be the mass Q so that this...

-

Compute the monthly payments on a 3-year lease for a $26,484 car if the annual rate of depreciation is 13% and the lease's annual interest rate is 5.3%. Round your answer to the nearest dollar.

-

If a 50 N block is resting on a steel table with a coefficient of static friction us = 0.74, then what minimum force is required to move the block?

-

A wholesale merchandising company uses the FIFO cost flow assumption. The beginning inventory balance was zero. Below is a worksheet showing inventory transactions for December 2020. What is the...

-

Consider the equal and opposite charges shown below. YA +Q++ a a (a) Show that at all points on the x-axis for which |x| a, Ex Browse... No file selected. This answer has not been graded yet....

-

A business buys two identical tangible personal property assets for the same identical price. It buys one at the beginning of the year and one at the end of year. Under what conditions would the...

-

Cassandra Casey operates the Futuristic Antique Store. She maintains subsidiary ledgers for accounts payable and accounts receivable. She presents you with the following information for October 2019:...

-

Pick a corporation of your choice and report on its cash position. Does it have any accounts receivable?

-

The chart of accounts for Kims Tree Trimming Service is as follows: Kims Tree Trimming Service completed the following transactions during the month of October: A. Sam Kim invested $30,000 in the...

-

On February 6, 202X, Anthony Pastore made the journal entry in Figure 3.33 to record the purchase on account of office equipment priced at $1,200. This journal entry had not yet been posted when the...

-

Suppose the North Carolina University system tests the idea that computerization of statistics classes increases student performance in the courses. If the computers are found to have a beneficial...

-

M. Handy is a self-employed painter who earned $32,400 last year. Her FICA tax rate is 15.3% of her earnings. How much FICA tax did she pay?

-

Using the same iThe Shouldice Hospital specializes in hernia operations. They have a special procedure that not only has a much higher rate of long-term success than other hospitals, but also allows...

Study smarter with the SolutionInn App