You gathered the following data from time cards and individual employee earnings records. Your tasks are as

Question:

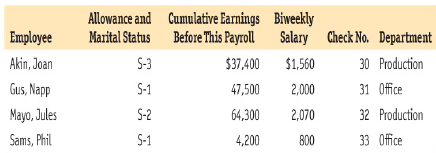

You gathered the following data from time cards and individual employee earnings records. Your tasks are as follows:

1. On December 5, 201X, prepare a payroll register for this biweekly payroll.

2. Calculate the employer taxes of FICA OASDI, FICA Medicare, FUTA, and SUTA.

3. Journalize the Payroll Register and the employer?s tax liability.

Assume the following:

1. FICA OASDI is 6.2% on $127,200; FICA Medicare is 1.45% on all earnings.

2. Federal income tax is calculated from Figure 7.2 .

3. State income tax is 9% of gross pay.

4. Union dues are $11 biweekly.

5. The SUTA rate is 5.0% and the FUTA rate is 0.6% on earnings up to $7,000.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

College Accounting A Practical Approach

ISBN: 9780134729312

14th Edition

Authors: Jeffrey Slater, Mike Deschamps

Question Posted: