Late in 2018, Felix Machine Company (FMC) management was considering expansion of the company?s international business activities.

Question:

Late in 2018, Felix Machine Company (FMC) management was considering expansion of the company?s international business activities. FMC is a South Carolina?based manufacturer of compound machines for use in industrial equipment. FMC?s worldwide market was supplied from subsidiaries in France, Brazil, and Taiwan, as well as from the United States. The company was particularly successful in Asia, mainly due to the high quality of its products, its technical expertise, and excellent after-sale service. This success led corporate management to consider the feasibility of further expansion of its business in the Asian region.

FMC?s Taiwanese subsidiary assembled and distributed machines and had limited manufacturing capability so that it could undertake special adaptations required. The Taiwanese subsidiary had been urging corporate management to expand its manufacturing capacity for several years. However, an alternative scenario appeared more promising. The Indian economy, with its liberalized economic policies, was growing at annual rates much higher than those of many industrialized countries. Further, India had considerably lower labor costs and certain government incentives that were not available in Taiwan. Therefore, FMC?s corporate management chose to first consider India for its Asian expansion and had a 4-year investment project proposal prepared by the chief financial officer?s staff.

The proposal involved establishing a wholly-owned subsidiary in India that would produce machines for the Indian domestic market as well as for export to other Asian countries. The initial equity investment would be $1.5 million, equivalent to 67.5 million Indian rupees (Rs) at the exchange rate of Rs 45 to the U.S. dollar. (Assume that the Indian rupee is freely convertible, and there are no restrictions on transfers of foreign exchange out of India.) An additional Rs 27 million would be raised by borrowing from a commercial bank in India at an interest rate of 10 percent per annum. The principal amount of the bank loan would be payable in full at the end of the fourth year. The combined capital would be sufficient to purchase plant and equipment of $1.8 million and would cover other initial expenditures, including working capital. The cost of equipment installation would be $15,000, with another $5,000 for testing. No additional working capital would be required during the 4-year period. The plant was expected to have a salvage value of Rs 10 million at the end of four years. Straightline depreciation would be applied to the original cost of the plant.?

The firm?s overall marginal after-tax cost of capital was about 12 percent. However, because of the higher risks associated with an Indian venture, FMC decided that a 16 percent discount rate would be applied in evaluating the potential project.?

Present value factors at 16 percent are as follows:

Period ................. factor

1.............................0.862

2.............................0.743

3.............................0.641

4.............................0.552

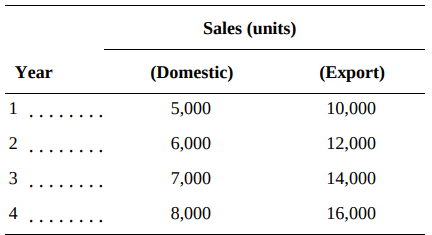

Sales forecasts (in units) are as follows:?

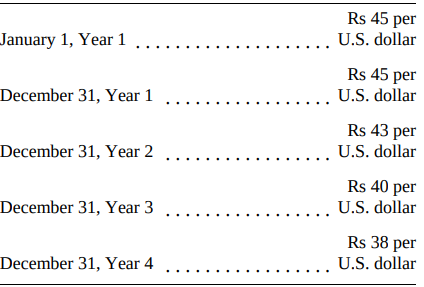

The initial selling price of a machine was to be Rs 4,500 for both Indian domestic sales and export sales in the Asian region, and the selling price in both cases was to increase at an annual rate of 10 percent. The exchange rate between the Indian rupee and the U.S. dollar was expected to vary as follows:

The cash expenditure for operating expenses, excluding interest payments, would be Rs 44 million in Year 1. This amount was expected to increase at a rate of 8 percent per year. The Indian subsidiary would be expected to pay a royalty of Rs 20 million to the parent company at the end of each of the four years. In addition, in those years in which the subsidiary generated a profit, it would pay a dividend to FMC equal to 100 percent of net earnings. Through negotiation with the Indian government, the subsidiary would be exempt from Indian corporate income taxes and withholding taxes on payments made to the parent company. Royalties received from the Indian subsidiary would be fully taxable in the United States at the U.S. corporate tax rate of 21 percent. Dividends received from the Indian subsidiary would be exempt from U.S. taxation.

Assuming the project proposal is accepted, FMC expects to be able to sell the Indian subsidiary at the end of the fourth year for its salvage value. FMC also expects to be able to repatriate to the parent the cash balance at the end of Year 4. The cash balance will be equal to the difference between the aggregate amount of cash from operations generated by the subsidiary and the aggregate amount of dividends paid to FMC, after paying back the local bank loan, plus salvage value. The repatriated cash balance will be taxed in the United States at 21 percent only if there is a gain after deducting the cost of the original investment.

Required:?

1. Calculate the NPV of the proposed investment in India from both a project and a parent company perspective.?

2. Recommend to Felix Machine Company?s corporate management whether or not to accept the proposal.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

International Accounting

ISBN: 978-1260466539

5th edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti, Hector Perera