The Year 1 financial statement of the Chinese subsidiary of Singcom Limited (a Singapore-based company) revealed the

Question:

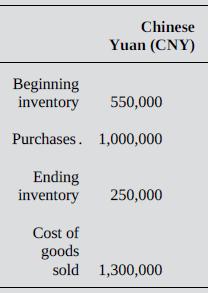

The Year 1 financial statement of the Chinese subsidiary of Singcom Limited (a Singapore-based company) revealed the following:

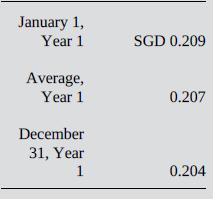

Singapore dollar (SGD) exchange rates for 1 CNY are as follows:

The beginning inventory was acquired in the last quarter of the previous year, when the exchange rate was SGD 0.210 = CNY 1; ending inventory was acquired in the last quarter of the current year, when the exchange rate was SGD 0.205 = CNY 1.

Required:

a. Assuming that the current rate method is the appropriate method of translation, determine the amounts at which the Chinese subsidiary’s ending inventory and cost of goods sold should be included in Singcom’s Year 1 consolidated financial statements.

b. Assuming that the temporal method is the appropriate method of translation, determine the amounts at which the Chinese subsidiary’s ending inventory and cost of goods sold should be included in Singcom’s Year 1 consolidated financial statements.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Exchange Rate

The value of one currency for the purpose of conversion to another. Exchange Rate means on any day, for purposes of determining the Dollar Equivalent of any currency other than Dollars, the rate at which such currency may be exchanged into Dollars...

Step by Step Answer:

International Accounting

ISBN: 978-1260466539

5th edition

Authors: Timothy Doupnik, Mark Finn, Giorgio Gotti, Hector Perera