As a separate project (Project P), you are considering sponsorship of a pavilion at the upcoming Worlds

Question:

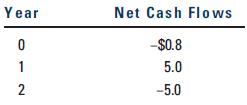

As a separate project (Project P), you are considering sponsorship of a pavilion at the upcoming World’s Fair. The pavilion would cost $800,000, and it is expected to result in $5 million of incremental cash inflows during its single year of operation. However, it would then take another year, and $5 million of costs, to demolish the site and return it to its original condition. Thus, Project P’s expected net cash flows look like this (in millions of dollars):

The project is estimated to be of average risk, so its cost of capital is 10%.

(1) What are normal and nonnormal cash flows?

(2) What is Project P’s NPV? What is its IRR? Its MIRR?

(3) Draw Project P’s NPV profile. Does Project P have normal or nonnormal cash flows? Should this project be accepted?

Step by Step Answer:

Corporate Finance A Focused Approach

ISBN: 978-1439078082

4th Edition

Authors: Michael C. Ehrhardt, Eugene F. Brigham