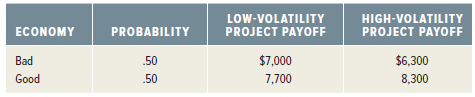

Sheaves Corporation economists estimate that a good business environment and a bad business environment are equally likely

Question:

a. What is the expected value of the firm if the low-volatility project is undertaken? What if the high-volatility project is undertaken? Which of the two strategies maximizes the expected value of the firm?

b. What is the expected value of the firm€™s equity if the low-volatility project is undertaken? What is it if the high-volatility project is undertaken?

c. Which project would the firm€™s stockholders prefer? Explain.

d. Suppose bondholders are fully aware that stockholders might choose to maximize equity value rather than total firm value and opt for the high-volatility project. To minimize this agency cost, the firm€™s bondholders decide to use a bond covenant to stipulate that the bondholders can demand a higher payment if the firm chooses to take on the high-volatility project. What payment to bondholders would make stockholders indifferent between the two projects?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan