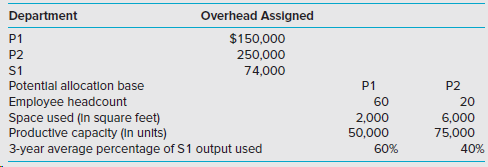

Great Ape Glassworks manufactures glass used for the screens on smartphones. It has two producing departments, P1

Question:

Required

1. Determine the total estimated overhead cost for each of the producing departments after allocating the cost of the service department:

a. Using employee headcount as the allocation base.

b. Using occupied space as the allocation base.

c. Using productive capacity as the allocation base.

d. Using the 3-year average use as the allocation base.

2. Which of the four proposed allocation bases would you recommend and why?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Cost Management A Strategic Emphasis

ISBN: 9781259917028

8th Edition

Authors: Edward Blocher, David F. Stout, Paul Juras, Steven Smith

Question Posted: