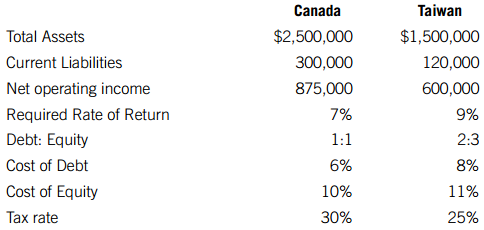

CLOC, an international company, produces and sells childrens watches in Canada and Taiwan. Each division operates as

Question:

CLOC evaluates its divisional managers€™ performance based on ROI and EVA. The divisional managers will receive a bonus equal to10% of the division€™s ROI, as long as the division has a 30% ROI and a positive EVA.

Required:

A. Calculate each division€™s ROI

B. Calculate each division€™s RI.

C. Calculate each division€™s EVA.

D. CLOC has an opportunity for the divisions to invest in a project costing $500,000 that would generate annual revenue of $700,000 and operating expenses of $520,000.Would the divisional manager be likely to proceed with this investment opportunity, if his/her bonus is equal to 10% of the division€™s ROI? Support your answer by calculating the new ROI and EVA, including the new investment.

Step by Step Answer:

Cost Management Measuring, Monitoring and Motivating Performance

ISBN: 978-1119185697

3rd Canadian edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott, Liang Hsuan Chen, Gail Cook