Since R 2 as a measure of goodness of fit is not particularly well suited for the

Question:

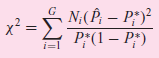

where Ni = number of observations in the ith cell

PÌ‚i = actual probability of the event occurring ( = ni/Ni)

Pˆ—i= estimated probability

G = number of cells (i.e., the number of levels at which Xi is measured, e.g., 10 in Table 15.4)

It can be shown that, for large samples, χ2 is distributed according to the χ2 distribution with (G ˆ’ k) df, where k is the number of parameters in the estimating model (k < G).

Apply the preceding χ2 test to regression (15.7.1) and comment on the resulting goodness of fit and compare it with the reported R2 value.

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: