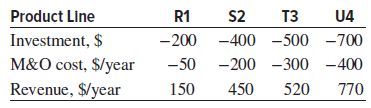

Abel and Family Perfumes wants to add one or more of four new products to its current

Question:

(a) Determine which of the four options the company should undertake on the basis of a present worth analysis, provided the total amount of investment capital available is $800,000. Use a hand solution, unless assigned otherwise.

(b) What products are selected if the investment limit is increased to $900,000? Use a spreadsheet, unless assigned otherwise. (All cash flows are in $1000 units.)

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: