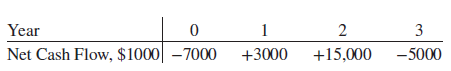

For the nonconventional net cash flow series experienced over the first 3 years of operation by Viking,

Question:

(a) Application of sign tests to determine the number and nature of the roots to the ROR equation.

(b) All real-number i* values between ˆ’100% and +100% using the IRR function.

(c) A plot of PW versus i values indicating the i* values found in part (b).

(d) The EROR values using the MIRR method at an investment rate of 10% and various borrowing rates ranging from 4% to 14%, in 2% increments (Viking does not know currently what it will cost to borrow additional funds, if needed).

(e) The EROR value using the ROIC method at the same 10% per year investment rate.

(f) Before you started your analysis, the owners told you they expected to realize at least a 25% per year return. With this MARR and your results, develop a short written summary for Julie and Carl€™s review and understanding of the different ROR values and interpretations, that is, for all of the i*, i€², and i€³ values. Tell them if they are meeting their MARR.

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Step by Step Answer: