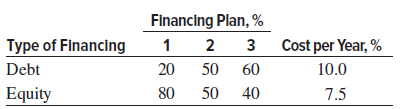

Mrs. McKays Nutrition Products has different methods by which a $600,000 project can be funded using debt

Question:

Determine the rate of return for each plan, and identify the ones that are economically acceptable if

(a) MARR equals the cost of equity capital,

(b) MARR equals the WACC,

(c) MARR is halfway between the cost of equity capital and the WACC.

(d) Do the decisions for the three financing plans support the fact that a highly leveraged project is more likely to be acceptable in that the rate of return on equity capital is higher? Explain the basis of your answer.

MARRMinimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other... Cost Of Equity

The cost of equity is the return a company requires to decide if an investment meets capital return requirements. Firms often use it as a capital budgeting threshold for the required rate of return. A firm's cost of equity represents the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: