Question:

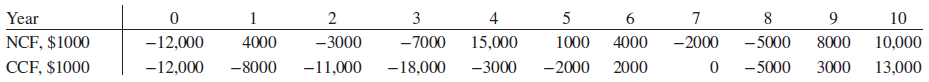

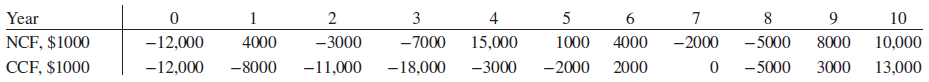

Ten years ago, JD and his colleagues resigned from a major aerospace corporation, after many years of salaried employment, to form JRG Solar, Inc. with the intent to make a significant impact on the international renewable energy market based on years of design and test work in neighborhood garages of the three partners. Additionally, they hoped to make at least 10% per year on their own and other investors€™ financial commitment to JRG Solar. They were successful in obtaining $12 million in capital funding to start the business. JD, who has always been the one most interested in the economic return side of the business, recently looked at the 10-year NCF series of JRG Solar (shown below in $1000 units). When he did a quick analysis on a spreadsheet, he saw that the IRR over the 10 years was 11.26% per year. He was very pleased with this return; however, he noticed that the NCF and cumulative cash flow (CCF) series both indicated multiple i* values. During this 10-year start-up phase of JRG Solar, the average investment rate for positive cash flows has averaged 4% per year. Since the investment rate is quite low for corporate retained earnings, and because the two rules-of-signchanges indicate multiple roots to the ROR equation, JD wants to understand the results of an ROR analysis beyond that of the simple ROR result (i* = 11.26%) that he obtained using the IRR function on the NCF series. Perform an ROIC analysis for JD to determine if JRG Solar€™s owners are realizing the

MARR of 10% per year that they anticipated.

MARR

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Transcribed Image Text:

3 2 5 Year NCF, $1000 CCF, $1000 4 10 - 5000 -5000 4000 -3000 15,000 1000 -2000 8000 -12,000 4000 -7000 -2000 10,000 13,000 -12,000 -8000 -11,000 -18,000 -3000 2000 3000