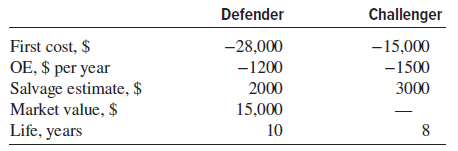

The Los Angeles, California, city engineer is analyzing a for-profit public works project at the port authority

Question:

(a) Perform the AW analysis by hand.

(b) Perform the evaluation using a spreadsheet.

(c) Would the decision be different if a beforetax replacement analysis were performed at i = 12% per year? Also, write the spreadsheet functions to display the AW values.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: