A. Describe Spatial Technologys business model in terms of revenues, profits, and cash flows. B. What intellectual

Question:

B. What intellectual properly, if any, does Spatial Technology possess?

C. Describe the experience and expertise characteristics of the management team.

D. Describe Spatial Technology€™s pricing and marketing strategy.

E. Discuss the competition faced by Spatial Technology in conjunction with 3D modeling technology in general and specifically with its CIS product.

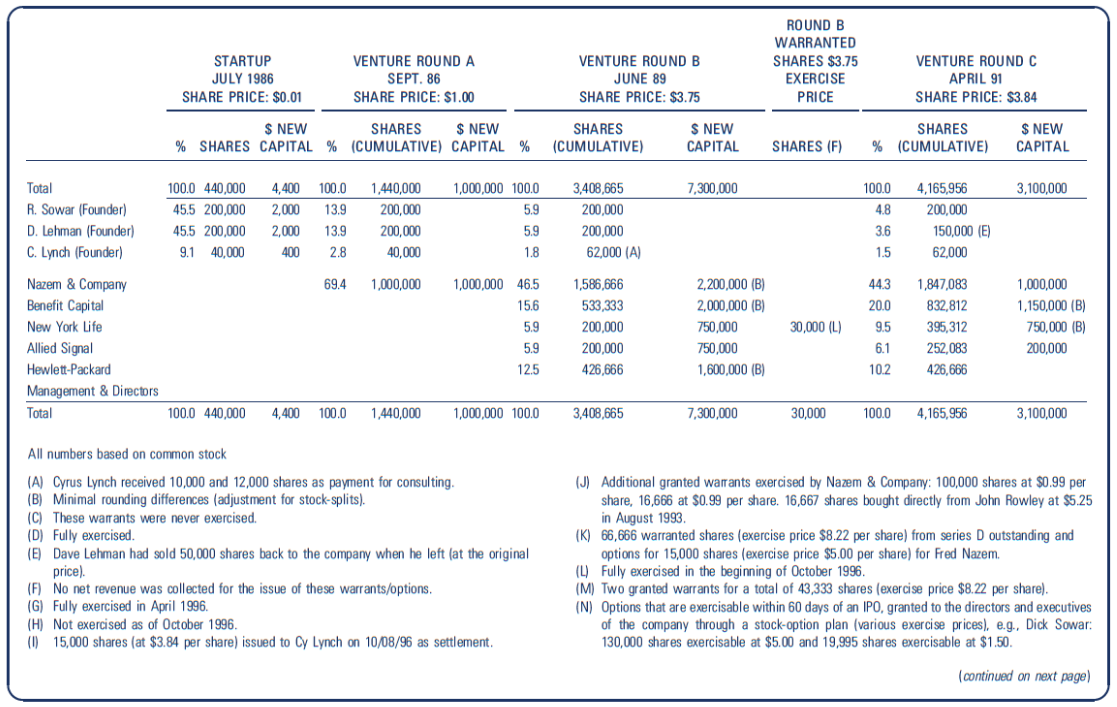

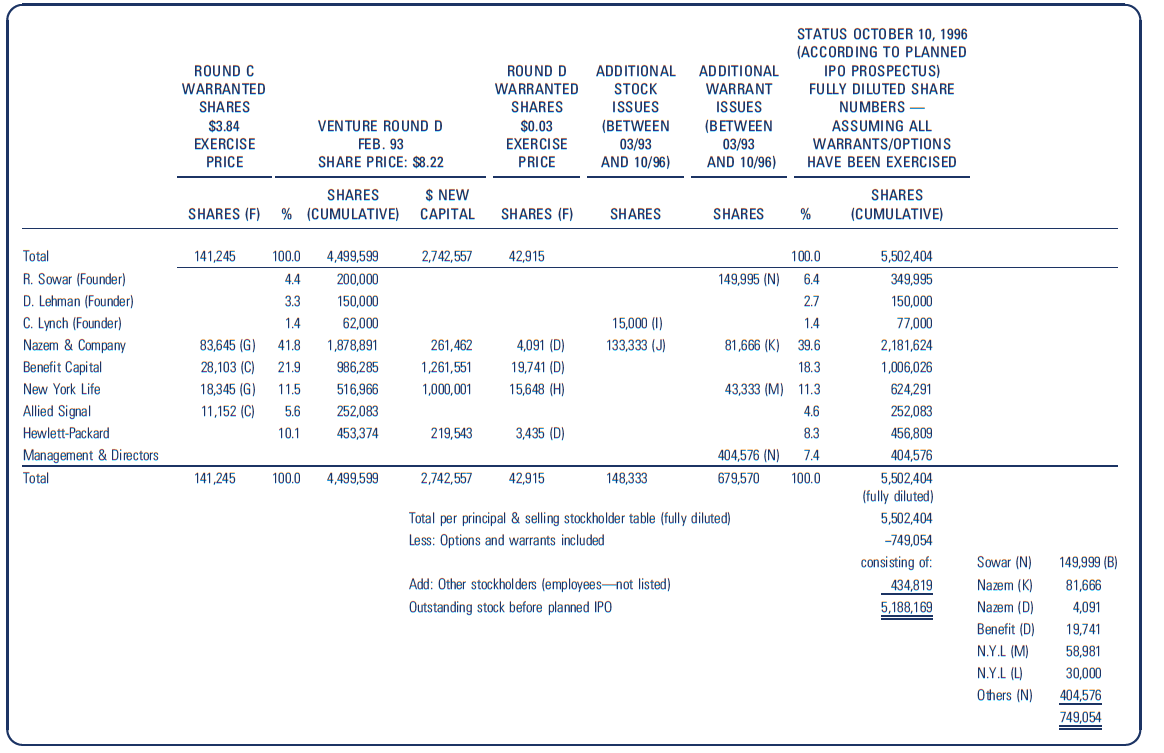

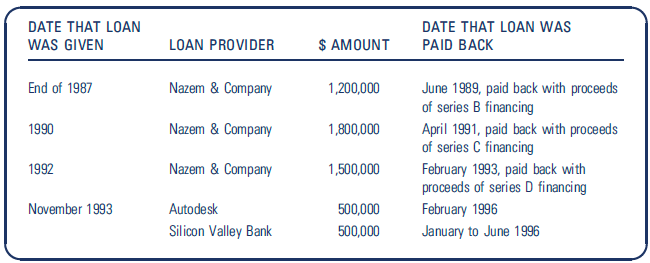

F. Describe the four successful rounds of venture financing (A through D) achieved by Spatial Technology in terms of sources and mounts. What additional financing sources have been used?

G. Conduct a ratio analysis of Spatial Technology€™s past income statements and balance sheets. Note any performance strengths and weaknesses and discuss any ratio trends.

H. Use the cash flow statements for Spatial Technology, Inc., to determine whether the venture has been building or burning cash, as well as possible trends in building or burning cash.

I. Discuss possible reasons why Spatial Technology€™s plan for an IPO of common stock at the end of 1992 was withdrawn.

J. Describe the IPO market conditions in 1996 and discuss possible reasons why the proposed IPO at a price of about $10 per share planned for October 1996 and involving Dain Bosworth as lead underwriter failed.

K. Evaluate the compound return on investments made at startup, Round A, Round B, Round C, and Round D if the acquired shares eventually sell at $10 and $5. Evaluate the compound return on all investments of each existing investor. Analyze the incentives of each investor and founder for taking the Cruttenden Roth offer to execute a $5 IPO.

L. Using the provided financial statements as a starting point:

1. Prepare and present a discounted cash flow valuation and pro forma financials with five years of explicit forecasts using license fees and royalties growth rates consistent with recent history (e.g., two to three years) at Spatial.

2. Modify your analysis to consider a more successful scenario where Spatial€™s main revenue sources (combined) grow at 50 percent for five years and then flatten to a more sustainable growth rate.

3. Prepare and present discounted cash flow valuations and pro forma financial statements (five-year explicit period) that justify a $10 share price and a $5 share price at the IPO. Make sure the ratios embedded in your projections conform to reasonable operating ratio assumptions.

4. In all cases, be sure to explain your modeling assumptions on revenue and costs and provide a summary comparison of the four scenarios.

M. Discuss the $5 and $10 IPO prices for Spatial within the context of comparable firms and their multiples. (There are some glimpses of multiples in the case materials, but you may wish to use some outside historical reference material. Please state your sources.)

N. Prepare an executive summary discussing the events and decisions (technological and financial) leading to its situation, the options it had, and your recommendations for Spatial€™s future. Would (could) you have done anything differently?

O. Take a position on whether you would recommend the $5 IPO. Take a position on whether, as an investor, you would have purchased shares in the $5 IPO.

P. Discuss what you believe would have been the strategic outlook for Spatial (product lines, licensing, competitors, etc.) at the time and what you believe would have been the financial market€™s view of a publicly traded Spatial Technology.

It was late afternoon on Thursday, October 10, 1996, when Richard €œDick€ Sowar leaned back in his office chair and tried to organize his thoughts. Only minutes earlier the chief executive officer (CEO) and founder of Spatial Technology had concluded a phone conference with his vice president of finance, his New York venture capitalist, and his Minneapolis-based investment bank. That phone conference had marked the end of what seemed to be the longest thirty-six hours of Sowar€™s life. During this time Spatial€™s investment bankers had tried to solicit a sufficient number of buy orders for the company€™s initial public offering (IPO), which had been scheduled for the following day. Having twice failed to fill the order book, however, the lead investment bank had canceled the IPO. As Spatial€™s CEO assessed his situation, he recalled the company€™s founding ten years earlier. The Origin of Spatial Technology After receiving a BS in mathematics from Marietta College and an MS in operations research, Sowar worked at the Air Force Graduate School in Ohio for several years. He then began doctoral studies in computer science at the University of Colorado while working as a research associate at Bell Laboratories and later joined a startup company. Sowar recalled: My partner Dave Lehman and I were part of starting up a CAD/CAM company called Graftek in 1980 in Boulder. We were using solid modeling technology from Shape Data Co. in England. I was VP of research and development; Dave Lehman was VP of engineering. Graftek was venture funded and ended up having more than thirty investors. When the Venture people wanted to cash out, Cyrus (Cy) Lynch was brought in to sell the company. Graftek was eventually acquired by Burroughs for $23 million in 1984. Subsequently, the entrepreneurial nature of Graftek changed and it became a very slow-moving company.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Discounted Cash Flows

What is Discounted Cash Flows? Discounted Cash Flows is a valuation technique used by investors and financial experts for the purpose of interpreting the performance of an underlying assets or investment. It uses a discount rate that is most...

Step by Step Answer:

Entrepreneurial Finance

ISBN: 978-1305968356

6th edition

Authors: J. Chris Leach, Ronald W. Melicher