The first quarter of 2008 had not yet ended and Steve Savage already knew the company would

Question:

Background:

Eco-Products had grown steadily and slowly since Steve and his father, Kent, founded the company in 1990. Friends and family supplied adequate support for business operations until 2005, when Steve assumed the company€™s first bank loan. The $30,000 line of credit had been increased to $4 million by 2007 and nearly been exhausted for working capital. A lengthy supply chain caused inventory build-up and impeded the company€™s ability to meet rapidly increasing demand for its products. More private funding would be needed to cover inventory and operating needs.Steve seriously began to consider venture capital equity financing when sales advanced more than 50 percent in May 2008 and the company€™s inventory ran low in many of its top selling items. He examined the list of serious investors who had been calling him regularly over the last year, opened a computer spreadsheet, and began calculating how much working capital was needed. Then he contemplated what percentage of ownership he would have to give up to obtain the funds the company needed.

A. Describe Eco-Products€™ early history (1990€“2003). Would you view the firm during that period as being a lifestyle business, an entrepreneurial venture, or something else? Why?

B. Discuss Eco-Products€™ revenue growth-based €œbusiness model€ that evolved over the 2004 through early 2008 period in terms of

(a) production versus distribution,(b) product line development, (c) branding, etc.

C. What is the size of the domestic and global markets for food service disposable packaging? Who are the major competitors producing/selling environmentally friendly food service products. What intellectual property or competitive advantages does Eco-Products, Inc., possess?

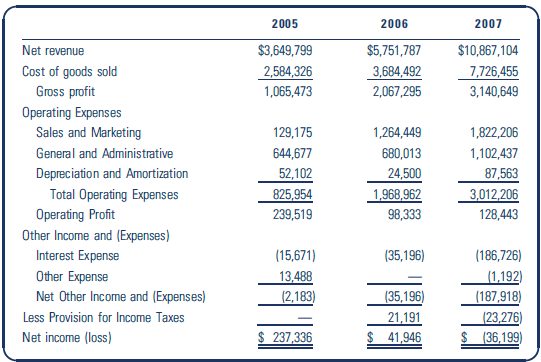

D. Tables 2 and 3 present Eco-Products€™ financial statement information for 2005, 2006, and 2007. Prepare a ratio analysis of the firm€™s financial performance over the 2005€“2007 period.

E. Table 4 presents Eco-Products€™ statement of cash flows for 2007. Was the firm building or burning cash in its operating activities? When also considering cash flows from investing activities, was Eco-Products in a net cash build or burn position in 2007?

F. Describe the early rounds of financing that occurred from Eco-Products€™ inception in 1990 through 2006. Beginning in 2007, the need for external financing began to increase. Describe the sources, amounts, and types of financing obtained during 2007 and the early part of 2008.

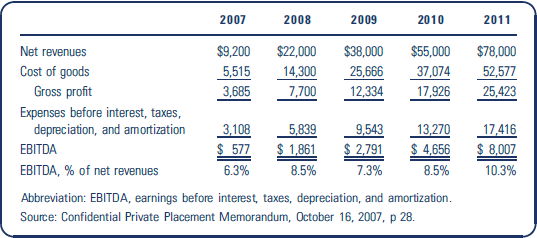

G. In mid-2007, Eco-Products€™ management prepared a five-year (2007€“2011) projection of revenues and expenses (see Table 1). What annual rates of growth were projected for net sales? Make a €œback-of-the-envelope€ estimate of the amounts of additional assets needed to support the sales forecasts. How might these assets be financed? Prepare a €œrough€ estimate of the possible size of external financing needed to support these sales projections.

H. Eco-Products€™ management developed a confidential private placement memorandum (PPM) dated October 16, 2007, in an attempt to raise $3,500,000. Appendix A contains excerpts from the PPM.

1. What is meant by a Regulation D offering? What is an accredited investor, and how many investors can participate in the PPM? [You may wish to review materials from Chapter 8 and its appendices when answering these PPM-related questions.]

2. Considering the planned use of proceeds, discuss the pros and cons of trying to raise $3,500,000 in increments as small as $50,000 each.

3. Summarize the risk factors listed by management in the PPM. Which factors do you believe are the most crucial in determining the future success of Eco-Products?

I. Identify and discuss the factors and developments that led to the previously unexpected revenue growth during the first-half of 2008 by Eco-Products. Is such growth likely to be sustainable in the near future? What possible developments might interrupt or change this rapid rate of sales growth?

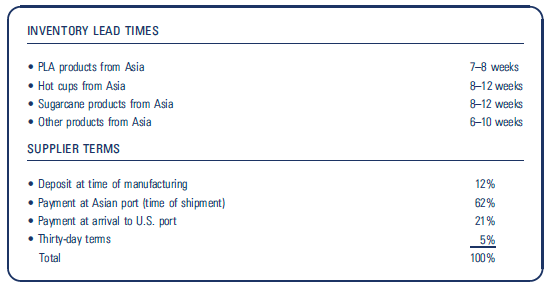

J. Explain Eco-Products€™ supply chain model that existed in early 2008. Describe the strengths and weaknesses of such a model from an operations viewpoint. What are the implications of this supply chain model on Eco-Products€™ working capital financing needs and its cash conversion cycle?

K. In mid-2008, Eco-Products€™ management sought to quickly (hopefully) raise an additional $2 million in external financing through a single private equity investment. The term sheet prepared by Greenmont Capital is presented in Appendix B.

1. After considering a number of possible private equity investors, Greenmont Capital was selected by Eco-Products€™ management. Discuss the pros and cons of selecting a small locally based private equity firm relative to a larger private equity investor.

2. Review the investment terms presented in Appendix B and comment on any factors in the term sheet that might be €œdeal breakers.€ If you were representing Eco-Products€™ top management, which terms might you want deleted or modified from the term sheet? If you were representing Greenmont Capital, which terms would be important in protecting its investment capital?

3. Some analysts use a relative value method that uses multiples from comparable firms to estimate the value of a target venture. Table 9 contains enterprise value-to-sales information for a number of possible comparable firms for the purpose of valuing Eco-Products. Estimate the enterprise value of Eco-Products. What portion of equity ownership should Eco-Products be willing to give up for the $2 million Greenmont Capital investment?

Cash conversion cycle measures the total time a business takes to convert its cash on hand to produce, pay its suppliers, sell to its customers and collect cash from its customers. The process starts with purchasing of raw materials from suppliers,... Line of Credit

A line of credit (LOC) is a preset borrowing limit that can be used at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. A LOC is...

Step by Step Answer:

Entrepreneurial Finance

ISBN: 978-1305968356

6th edition

Authors: J. Chris Leach, Ronald W. Melicher