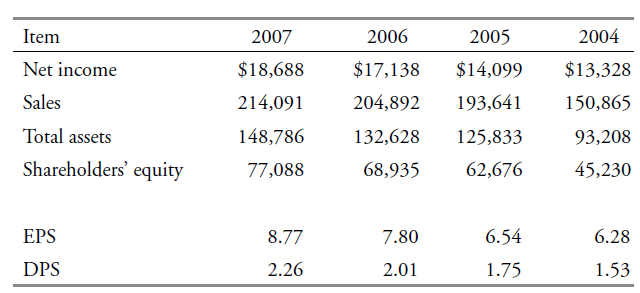

An analyst following Chevron Corp. (NYSE Euronext: CVX) wants to estimate the sustainable growth rate for the

Question:

A. Compute the average value of each PRAT component during 2005 €“ 2007.

B. Using the overall mean value of the average component values calculated in part A, estimate the sustainable growth rate for Chevron.

C. Judge whether Chevron has reached a mature growth stage.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Equity Asset Valuation

ISBN: 978-0470571439

2nd Edition

Authors: Jerald E. Pinto, Elaine Henry, Thomas R. Robinson, John D. Stowe, Abby Cohen

Question Posted: