The management of Telluride, an international diversified conglomerate based in the United States, believes that the recent

Question:

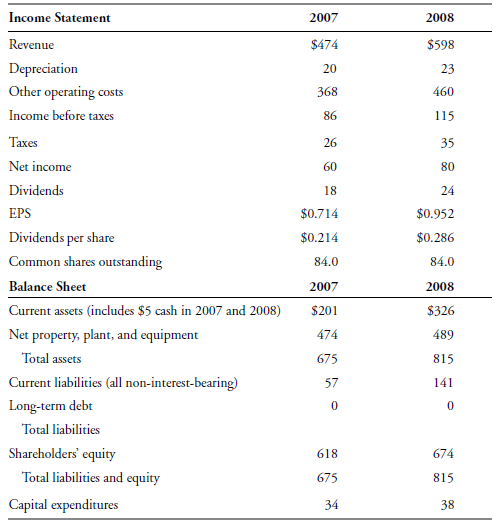

EXHIBIT 4-19 Sundanci Actual 2007 and 2008 Financial Statements for Fiscal Years

Ending 31 May (dollars in millions except per-share data)

EXHIBIT 4 - 20 Selected Financial Information

Required rate of return on equity ........14%

Industry growth rate ............................13%

Industry P/E ........................................26

Abbey Naylor, CFA, has been directed by Carroll to determine the value of Sundanci€™s stock by using the FCFE model. Naylor believes that Sundanci€™s FCFE will grow at 27 percent for two years and at 13 percent thereafter. Capital expenditures, depreciation, and working capital are all expected to increase proportionately with FCFE.

A. Calculate the amount of FCFE per share for 2008 by using the data from Exhibit 4 - 19.

B. Calculate the current value of a share of Sundanci stock based on the two - stage FCFE model.

C. Describe limitations that the two - stage DDM and FCFE models have in common.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Equity Asset Valuation

ISBN: 978-0470571439

2nd Edition

Authors: Jerald E. Pinto, Elaine Henry, Thomas R. Robinson, John D. Stowe, Abby Cohen