Barry Potter and Winnie Weasley are considering making an S election on March 1, 2019, for their

Question:

€¢ Winnie is a U.S. citizen and resident.

€¢ Barry is a citizen of the United Kingdom, but a resident of the United States.

€¢ Barry and Winnie each own 50 percent of the voting power in Omniocular. However, Barry€™s stock provides him with a claim on 60 percent of the Omniocular assets in liquidation.

€¢ Omniocular was formed under Arizona state law, but it plans on eventually conducting some business in Mexico.

a. Is Omniocular eligible to elect S corporation status? If so, when is the election effective? For the remainder of the problem, assume Omniocular made a valid S election effective January 1, 2019. Barry and Winnie each own 50 percent of the voting power and have equal claim on Omniocular€™s assets in liquidation. In addition, consider the following information:

€¢ Omniocular reports on a calendar tax year.

€¢ Omniocular€™s earnings and profits as of December 31, 2018 were $55,000.

€¢ Omniocular€™s 2018 taxable income was $15,000.

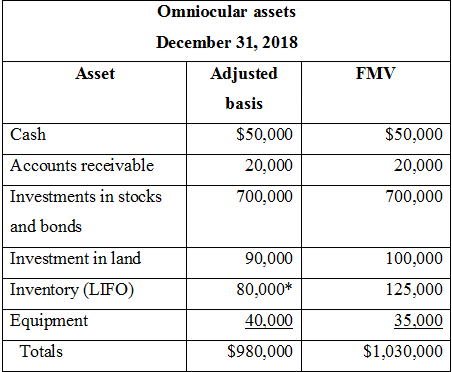

€¢ Omniocular€™s assets at the end of 2018 are as follows:

*$110,000 under FIFO accounting.

€¢ On March 31, 2019, Omniocular sold the land for $42,000.

€¢ In 2019, Omniocular sold all the inventory it had on hand at the beginning of the year. This was the only inventory it sold during the year.

Other Income/Expense Items for 2019

Sales Revenue.............................$155,000

Salary to owners.........................(50,000)

Employee wages.........................(10,000)

Depreciation expense................(5,000)

Miscellaneous expenses............(1,000)

Interest income...........................40,000

Qualified dividend income.........65,000

€¢ Assume that if Omniocular were a C corporation for 2019, its taxable income would have been $88,500.

b. How much LIFO recapture tax is Omniocular required to pay and when is it due?

c. How much built-in gains tax, if any, is Omniocular required to pay?

d. How much excess net passive income tax, if any, is Omniocular required to pay?

e. Assume Barry€™s basis in his Omniocular stock was $40,000 on January 1, 2019. What is his stock basis on December 31, 2019? For the following questions, assume that after electing S corporation status Barry and Winnie had a change of heart and filed an election to terminate Omniocular€™s S election, effective August 1, 2020.

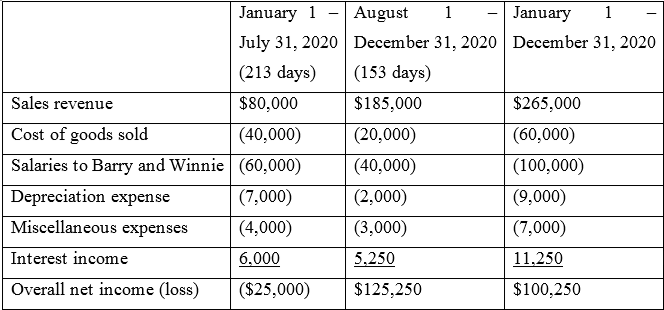

€¢ In 2020, Omniocular reported the following income/expense items:

f. For tax purposes, how would you recommend Barry and Winnie allocate income between the short S corporation year and the short C corporation year if they would like to minimize double taxation of Omniocular€™s income?

g. Assume in part (f) that Omniocular allocates income between the short S and C corporation years in a way that minimizes the double taxation of its income. If Barry€™s stock basis in his Omniocular stock on January 1, 2020, is $50,000, what is his stock basis on December 31, 2020?

h. When is the earliest tax year in which Omniocular can be taxed as an S corporation again?

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Essentials Of Federal Taxation 2019

ISBN: 9781260190045

10th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver