Bankston Feed and Supply Company buys on terms of 1/10, net 30, but it has not been

Question:

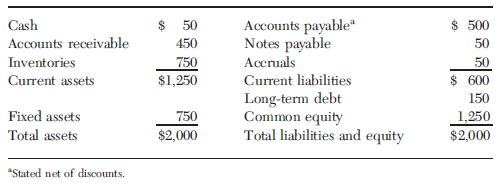

Now Bankston€™s suppliers are threatening to stop shipments unless the company begins making prompt payments (that is, paying in 30 days or less). The firm can borrow on a one-year note (call this a current liability) from its bank at a rate of 15 percent, discount interest, with a 20 percent compensating balance required. (Bankston€™s $50,000 in cash is needed for transactions; it cannot be used as part of the compensating balance.)

a. Determine what action Bankston should take by calculating (1) the cost of non-free trade credit and (2) the cost of the bank loan.

b. Assume that Bankston forgoes discounts and then borrows the amount needed from the bank to become current on its pay-ables. How large will the bank loan be?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Essentials of Managerial Finance

ISBN: 978-0324422702

14th edition

Authors: Scott Besley, Eugene F. Brigham