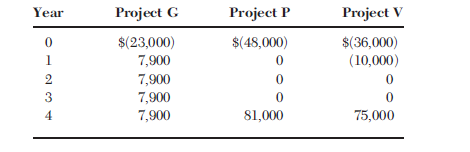

Compute the internal rates of return (IRRs) for the following capital budgeting projects: Based on IRRs, under

Question:

Based on IRRs, under what conditions should each project be purchased?

Capital BudgetingCapital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the...

Transcribed Image Text:

Project V $(36,000) (10,000) Project G $(23,000) 7,900 Project P Year $(48,000) 7,900 7,900 3 75,000 4 7,900 81,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (12 reviews)

Year Project G Project P Project V 0 23000 48000 36000 1 7900 0 10000 2 7900 0 0 3 79...View the full answer

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Essentials of Managerial Finance

ISBN: 978-0324422702

14th edition

Authors: Scott Besley, Eugene F. Brigham

Question Posted:

Students also viewed these Business questions

-

Using the internal rate of return to compare investment opportunities Hulsey and Wright (H&W) is a partnership that owns a small company. It is considering two alternative investment opportunities....

-

Perez and Soto (P&S) is a partnership that owns a small company. It is considering two alternative investment opportunities. The first investment opportunity will have a five-year useful life, will...

-

Hosier and Wogan (H&W) is a partnership that owns a small company. It is considering two alternative investment opportunities. The first investment opportunity will have a five-year useful life, will...

-

How to find the expected utility of profit under each alternative crop Table 1. Annual Returns to Cropping Alternatives ($ profit / acre) Outcome Worst Bad OK Good Great Probability 0.1 0.2 0.4 0.2...

-

A series of drained direct shear tests were performed on a saturated clay. The results, when plotted on a Mohr diagram, gave c' = 10 kPa and tan ' = 0.5. Another specimen of this clay was...

-

Why is the protection of marine biodiversity inadequate in the 1982 UN Convention on the Law of the Sea?

-

Derive equation (4.1) for the total sample of the two-sample t-test. Data from Equation 4.1 n = 2 40 (21-a/2 + 21-3)

-

Determine the force in each member of the double scissors truss in terms of the load P and state if the members are in tension or compression. B L/3 -L13 L13- P.

-

1. In the election shown below under the Plurality method, explain why voters in the third column might be inclined to vote insincerely. How could it affect the outcome of the election? Number of...

-

A 50-fi lossless line is 4.2 m long. At the operating frequency of 300 MHz, the input impedance at the middle of the line is 80 j60. Find the input impedance at the generator and the voltage...

-

Consider the structure of cis-1, 2-divinylcyclopropane: This compound is stable at low temperature but rearranges at room temperature to produce 1, 4-cycloheptadiene. (a) Draw a mechanism for this...

-

How do biologists define evolution?

-

For the reaction HCO3-H++CO32-,HCO - 3 H - + CO 3 2- , G=+59.0 kJ/molG = +59.0 kJ /mol at 298.15 K. 298.15 K. Find the value of KK for the reaction.

-

Find volume and density using the following table. Table 1 Length Width Height Mass 1 2.558 2.555 2.559 17 2 2.557 2.562 2.557 17 3 2.567 2.550 2.561 17 4 2.569 2.556 2.564 17 mean 2.563 2.556 2.560...

-

Sandhill Company purchased a machine on January 1 , 2 0 2 2 for $ 9 4 5 0 0 0 . At the date of acquisition, the machine had an estimated useful life of 6 years with no salvage. The machine is being...

-

The records of Tillman Corporation's initial and unaudited accounts show the following ending inventory balances, which must be adjusted to actual costs: Units Unaudited Costs Work - in - process...

-

Take - a - Break Travel Company offers spring break travel packages to college students. Two of its packages, a 7 - day, 6 - night trip to Cancun and a 5 - day, 4 - night trip to Jamaica, have the...

-

A shoe manufacturer with a marginal cost of capital of 7% is evaluating new equipment that would custom fit athletic shoes. The new equipment costs $90,000 and will generate $35,000 in net cash flows...

-

In how many ways can the digits in the number 4,568,865 be arranged?

-

Problem 3.5 (4 points). We will prove, in steps, that rank (L) = rank(LT) for any LE Rnxm (a) Prove that rank (L) = rank (LTL). (Hint: use Problem 3.4.) (b) Use part (a) to deduce that that rank(L) =...

-

Suppose Ford Motor Company sold an issue of bonds with a 10-year maturity, a $1,000 par value, a 10 percent coupon rate, and semiannual interest payments. a. Two years after the bonds were issued,...

-

Ewald Companys current stock price is $36, and its last dividend was $2.40. In view of Ewalds strong financial position and its consequent low risk, its required rate of return is only 12 percent. If...

-

The Desreumaux Company has two bond issues outstanding. Both bonds pay $100 annual interest plus $1,000 at maturity. Bond L has a maturity of 15 years and Bond S has a maturity of one year. a. What...

-

MR Green is one of the resident for who you take care in a nursing home .He is recovering from a stroke and has a pressure ulcer . In addition he is disoriented and confuse . However he can feed...

-

What does the accountability of prescriptive theory? b. What does the accountability of capture theory? c. What does the accountability of normative accounting theory? d, What does the accountability...

-

Describe the connections between leader accountability and how leaders hold people accountable for their actions? sustainability through accountability.

Study smarter with the SolutionInn App