Presented on the following pages are partial financial statements for the City of Shenandoah, including: Fiscal year

Question:

Presented on the following pages are partial financial statements for the City of Shenandoah, including:

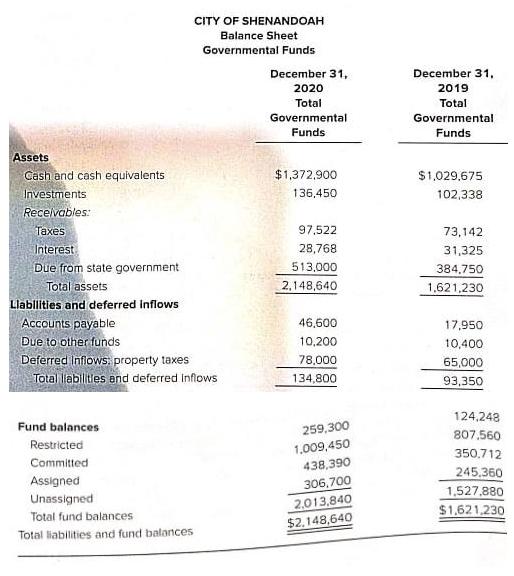

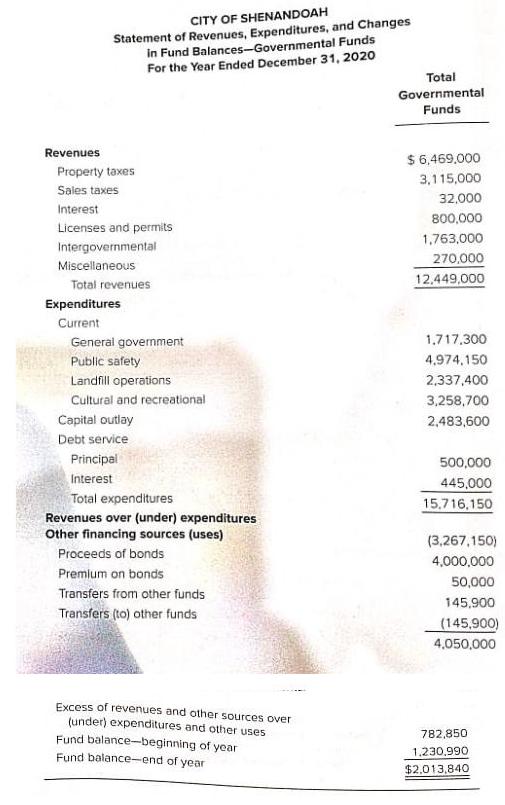

Fiscal year 2020:

A. Total Governmental Funds:

Balance Sheet

Statement of Revenues, Expenditures, and Changes in Fund Balances

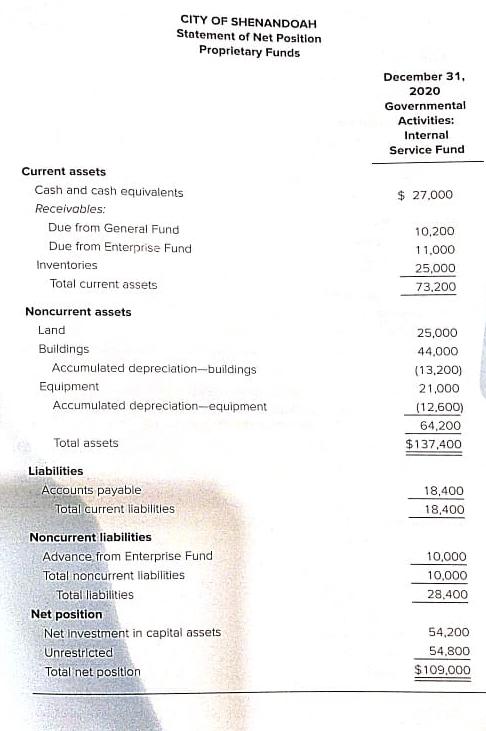

B. Internal Service Fund:

Statement of Net Position

Statement of Revenues, Expenses, and Changes in Net Position

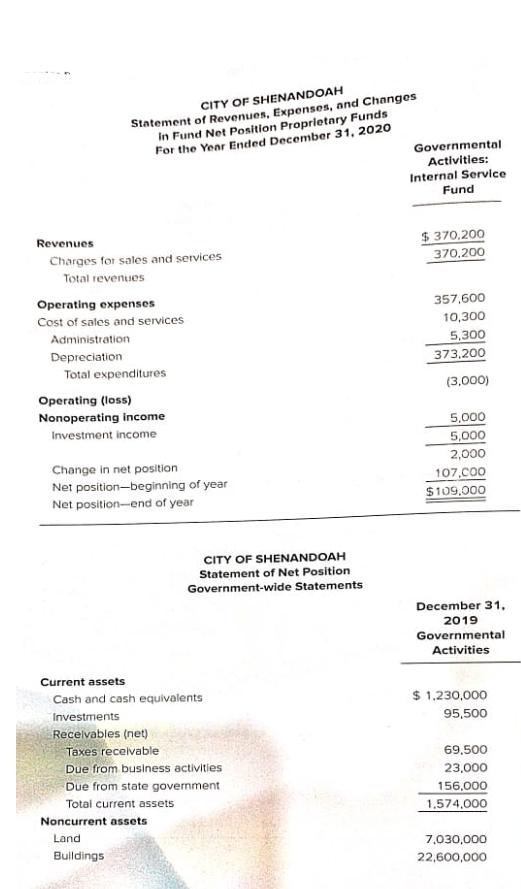

Fiscal year 2019:

A. Total Governmental Funds:

Balance Sheet

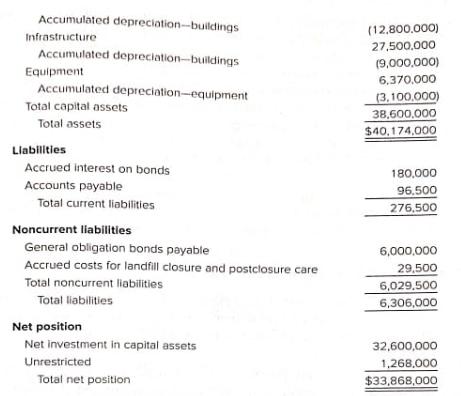

B. Government-wide—Governmental Activities:

Statement of Net Position

Additional Information

1. $856,700 of the capital assets purchased in fiscal year 2020 was equipment. All remaining capital acquisitions were for a new building.

2. Depreciation of general fixed assets: buildings $1,100,000, infrastructure $975,000, and equipment $537,500.

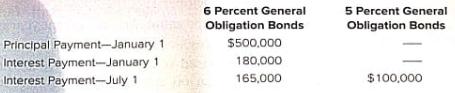

3. The City had $6,000,000 of 6 percent general obligation bonds (issued at par) outstanding at December 31, 2019. In addition, the City issued $4,000,000 of 5 percent bonds on January 2, 2020 (sold at a premium). Interest payments on both bond issues are due on January 1 and July 1. Principal payments are made on January 1. Interest and principal payments for the current year include:

The January interest payments are accrued for purposes of the governmentwide statements but not the fund-basis statements. The bond premium is to be amortized in the amount of $2,500 per year.

4. Property taxes expected to be collected more than 60 days after year-end are deferred in the fund-basis statements.

5. At the end of 2020, the accumulated liability for landfill closure and postclosure care costs is estimated to be $36,500. Landfill operations are reported in the General Fund—Public Works.

6. The internal service fund serves several departments of the General Fund, all within the category of “General Government.” The internal service fund was created at the end of 2019 and had no capital assets or long-term liabilities at the end of 2019. Prepare all worksheet journal entries necessary for fiscal year 2020 to convert the governmental fund-basis amounts to the economic resources measurement focus and accrual basis required for the governmental activities sections of the government-wide statements.

Step by Step Answer:

Essentials Of Accounting For Governmental And Not-for-Profit Organizations

ISBN: 9781260570175

14th Edition

Authors: Paul Copley